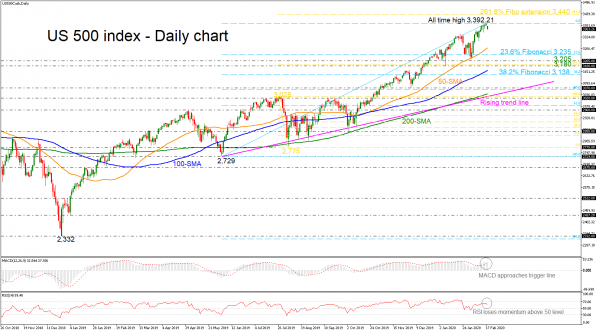

The US 500 index (Cash) is retreating after pivoting from the all-time high of 3,392.21 reached on Monday. The long-term picture remains strongly bullish, however, in the very short-term, the technical indicators are suggesting a possible downside correction. The MACD is heading south in the positive territory, while the RSI is sloping down above the 50 level.

In the wake of negative pressures, the market could meet support at the 50-day simple moving average (SMA) currently at 3,270 before it heads lower to the 23.6% Fibonacci retracement level of the up leg from 2,729 to 3,392.21 at 3,235. Marginally below this level, the 3,205 and 3,180 obstacles are coming next before meeting the 38.2% Fibo of 3,138.

On the other side, a move to the upside could see immediate resistance at the record high of 3,392.21 but should the market increase positive momentum above this area, the 261.8% Fibonacci extension level of the down leg from 3,028 to 2,775 near 3,440 could follow.

Summarizing, the US500 stock index could face more upside pressure in the long-term if it surpasses the all-time high. Noteworthy, is the price, which has been developing above the ascending trend line since June 2019.