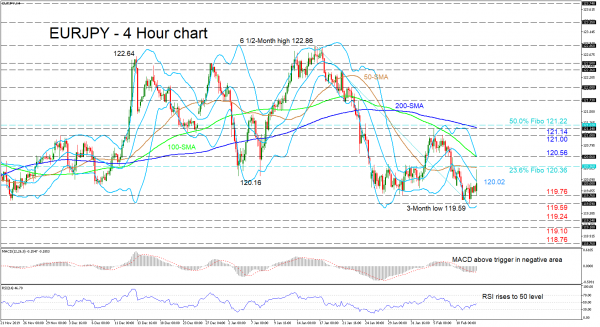

EURJPY reversed from a fresh three-month low of 119.59 but remains capped by the 50-period simple moving average (SMA). The move is backed by the improving momentum indicators and the flattening in the 50-period SMA.

The MACD in the negative region is increasing above its red trigger line, while the rising RSI has reached its neutral mark. That said, traders need to be aware of the intact negative picture reflected within the SMAs, which may keep the outlook neutral-to-bearish.

Persisting buyers could approach initial resistance at the 120.36 level, which is the 23.6% Fibonacci retracement of the down leg from 122.86 to 119.59 and where the 50-period SMA currently resides. Surpassing this, the inside swing low of 120.56 – where the 100-period SMA and upper-Bollinger band have converged – may prove to be a tough obstacle to overcome. Overrunning this hurdle, the bulls would need to breach the 121.00 psychological number before tackling a resistance region from 121.14 to 121.22, involving the latest high, the captured 200-period SMA and the 50.0% Fibo.

If sellers manage to steer back below the mid-Bollinger band around 120.00, the 119.76 support and 119.59 low may be next to limit downside corrections. Diving past the lower-Bollinger band, the decline could meet the 119.24 and 119.10 barriers from back in November and October of 2019 respectively. If these are conquered, attention may turn towards the 118.76 swing low from October 2019.

Overall, the near-term picture remains neutral-to-bearish below the 120.36 level and bearish below the 121.22 mark.