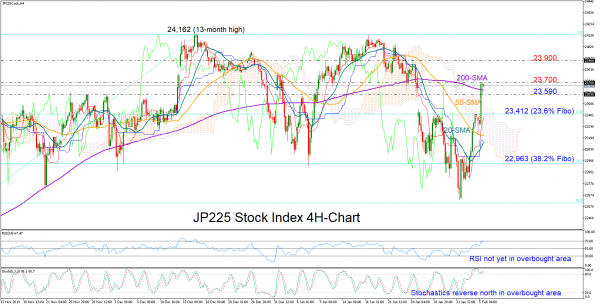

Japan’s 225 stock index staged an impressive rally earlier on Wednesday to cross above the Ichimoku cloud and close on top of the 200-period simple moving average (SMA) on the four-hour chart.

Technically, there is still some room for improvement as the Stochastics are reversing north again within the overbought area at a time when the RSI keeps rising to reach its 70 overbought mark.

The 23,700 level seems like a hurdle for the bulls at the moment but if it soon falls apart, more gains could follow until 23,900. Higher, the spotlight would shift towards the 24,162 peak.

In the negative scenario, if the price returns below the 200-period SMA, the 23,590 mark could immediately retake control as it did today. In case it fails to hold, the bears may next challenge the former resistance region around 23,412 which is also where the 23.6% Fibonacci of the 21,204-24,612 bullish wave (October-December) is placed. Breaching the latter too, another key barrier may emerge around the 38.2% Fibonacci of 22,963.

Summarizing, Japan’s 225 index continues to face a bullish bias in the short-term though any additional gains could prove limited as the market seems to be trading in overbought waters.