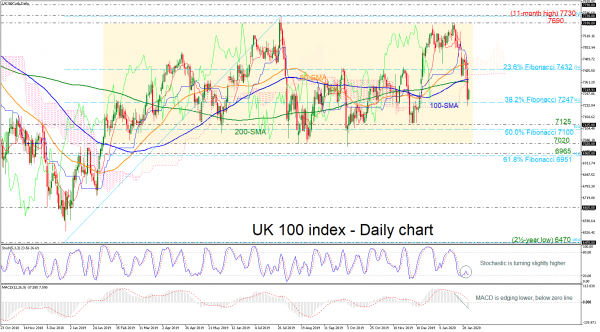

The UK 100 index has been developing within a one-year consolidation area with upper boundary the 7,690 resistance level and lower boundary the 7,020 support. In the latest move, the price tumbled to a fresh three-week low of 7,230.94 on Friday but the 38.2% Fibonacci retracement level of the upward movement from 6,470 to 7,730 helped it to recover a bit on Monday.

In technical indicators, the stochastic oscillator is still pointing to the 20 oversold mark, while the MACD continues to strengthen to the downside and below its trigger and zero lines, both suggesting that the bearish bias has not faded yet.

If sellers take the upper hand below the 38.2% Fibo of 7,247, the price could weaken until the 7,125 support. More losses could see the 50.0% Fibo of 7,100 and the 7,020 barrier.

A bounce off the 7,247 support could send prices towards the 100- and 200-day simple moving averages (SMAs) currently near 7,370. Marginally above those lines, the index may test the lower surface of the Ichimoku cloud, which coincides with the 23.6% Fibonacci mark of 7,432. Above that, the 50-day SMA at 7,463 may next take control and before the 7,690 high, registered on January 17.

Overall, while the index is lacking direction in the long-term, in the near-term bearish movements are still likely as confirmed by the momentum indicators.