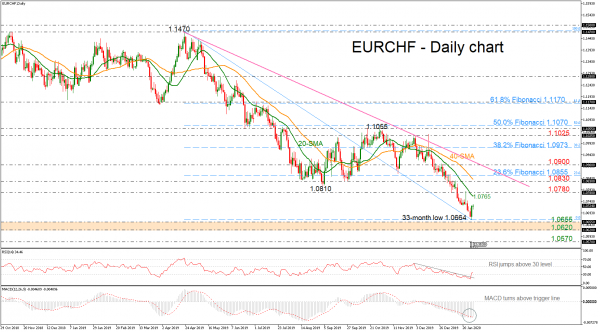

EURCHF reversed higher on Tuesday after the slip to a new 33-month low of 1.0664. In the longer timeframe, the price is still standing in a strong bearish mode since April 2019.

From the technical view point, the RSI broke the descending line within the oversold region and exited/jumped above the 30 level. Moreover, the MACD oscillator is posting a bullish crossover with its trigger line in the negative area, suggesting a possible pullback in the short-term.

The 20-day simple moving average (SMA) at 1.0765 level is the nearest resistance that could reject any attempt higher. If not and the price extends positive momentum the 1.0780 level could take over ahead of the area of 1.0830 – 1.0855, which includes the 40-day SMA and the 23.6% Fibonacci retracement level of the down leg from 1.1470 to 1.0664.

Alternatively, a strong sell-off below the multi-month low could open the way for the 1.0620 – 1.0655 support zone. Should it fail to hold, the 1.0570 hurdle, registered by the inside swing high on May 2015 would be the next target.

In brief, EURCHF is facing upside pressure in the very short-term, with buyers waiting for a decisive close above 1.0900 to restore optimism over an up-trending market in the medium-term timeframe.