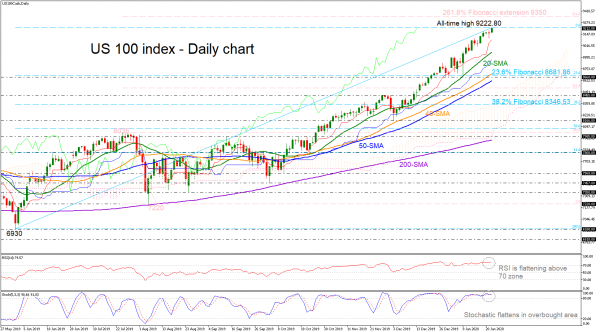

The US 100 stock index is continuing the strong upside rally, creating new record intraday highs every single day over the last four sessions. Today, the price hit the 9222.80 level, remaining well above the short- and long-term simple moving averages (SMAs).

The technical indicators are supposing a potential downside correction as both, the RSI and the stochastic, are developing in overbought areas, suggesting the end of the significant gaining period. The RSI is losing momentum above the 70 level as it is flattening, while the %K line of the stochastic, completed a bearish crossover with the %D line in the strong positive area.

If the index remains to expand above today’s high, a new top could probably be formed around the 261.8% Fibonacci extension level of the downward wave from 8035 to 7220 around 9350. More upside pressures could send it towards psychological numbers such as 9500 and 10000.

A reversal to the downside could stall at the 23.6% Fibonacci mark of the upward movement from 6930 to 9222.80 at 8681.86, which encapsulates the 8660 support and the 40-day SMA. Deeper downside correction could flirt with the 8455 barrier, challenging the Ichimoku cloud as well.

All in all, the picture continues to look strongly bullish, with trading activity taking place near all-time highs.