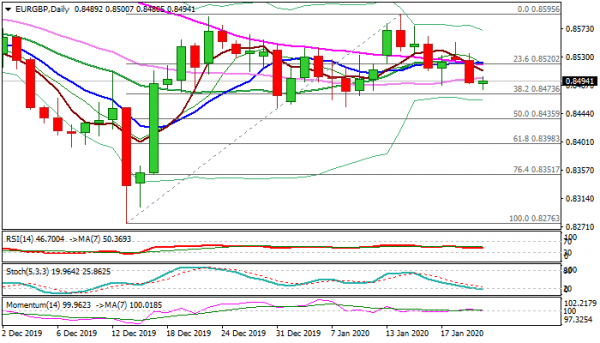

The cross is consolidating above pivotal Fibo support at 0.8473 (Fibo 38.2% of 0.8276/0.8595) following Tuesday’s 0.4% drop, initiated by upbeat UK labor data.

Sterling remains firm but needs more signals about BoE’s action on policy meeting next week, as strong jobs numbers on Tuesday reduced risk of rate cut and today’s release of CBI manufacturing order could give more hints.

Positive environment could boost sterling and push the pair through 0.8473 and 0.8454 (31 Dec / 8 Jan higher base) that would generate an initial signal of break of directionless mode in past one month, which left four consecutive weekly Dojis.

Weakening daily studies support the notion, while weekly 20/200DMA death-cross weighs.

At the upside, converged 10/20/55DMA’s offer solid resistance at 0.8520, break of which would sideline bears.

Res: 0.8500, 0.8520, 0.8535, 0.8560

Sup: 0.8473, 0.8454, 0.8435, 0.8398