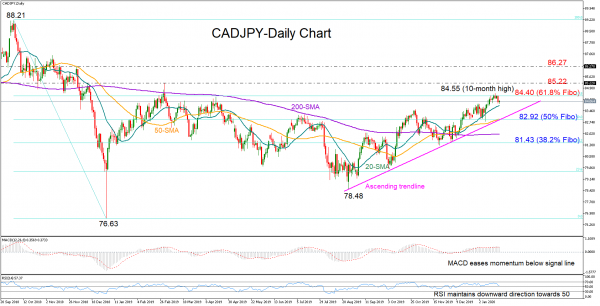

CADJPY bulls run out of fuel near a 10-month high of 84.55 and the 61.8% Fibonacci of the 89.20-76.63 downleg recorded between the 2018 October-January period.

The easing momentum in the RSI and the MACD suggests that weakness may remain in the market in the short-term as the former is holding a downward direction and the latter is ready to cross below its red signal line.

On the positive side, the pair is trading in an uptrend in the medium-term picture and only a drop below the ascending trendline drawn from the 78.48 bottom would put the upward direction in question. Before meeting the supportive trendline, the 20-day simple moving average (SMA) could provide some floor to any downside correction, while beneath the line and the 50% Fibonacci of 82.92, the spotlight will shift to the 38.2% Fibonacci of 81.43.

Looking for fresh highs above 84.55, the price may find immediate resistance around 85.22 taken from the peak on March 1. If that obstacle proves easy to get through, the rally could continue until the 86.27 barrier.

In brief, CADJPY is expected to maintain weak momentum in the short-term. Meanwhile, the supportive trendline will be closely eyed as any significant break below it would put the uptrend in the medium-term picture in doubt.