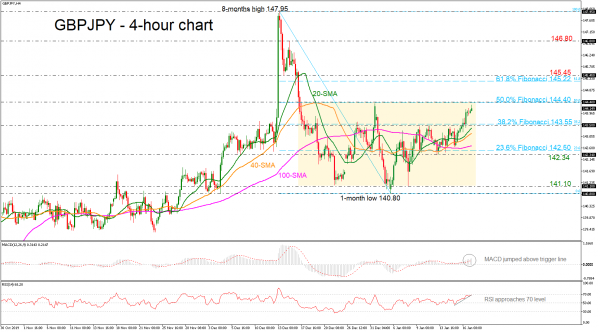

GBPJPY is trading sideways over the last month, struggling within the 50.0% Fibonacci retracement level of the downleg from 147.95 to 140.80 near 144.40 and the 141.10 support level. However, looking at the very short-term timeframe the pair rebounded on the 140.80 barrier on January 6 and surpassed the moving averages, suggesting an upward wave.

The technical indicators are suggesting an upside tendency as well. The MACD jumped above its trigger line and it is holding in the positive area, while the RSI is approaching the overbought level with strengthening momentum.

If the price has a successful attempt above the key resistance of 144.40 it would open the way for the 61.8% Fibo of 145.22 before challenging the inside swing trough of 145.45, identified on December 13.

On the other hand, a tumble beneath the 38.2% Fibo of 143.55 could drive the price towards the 20- and 100-simple moving averages (SMAs) near 143.40 and 142.70. Slightly lower, the 23.6% Fibo of 142.50 could be a crucial level for traders as the price is returning in the middle of the short-term trading range.

All in all, GBPJPY would increase bullish sentiment if there were to be of a close above the upper boundary of the consolidation area at 144.40 in the 4-hour chart.