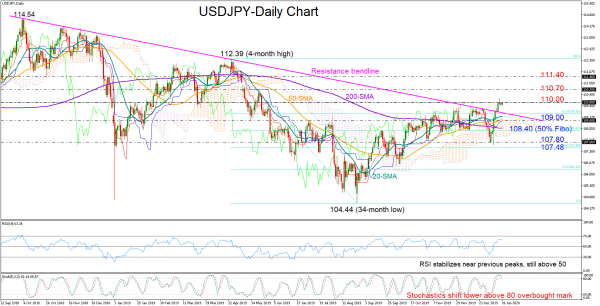

USDJPY is stuck below the 110.00 level after closing above the strong resistance trendline stretched from mid-September 2018.

In the short-term, the pair is expected to trade with caution as the slowdown in the RSI’s positive momentum, which is currently near its former peaks, and the negative intersection between the Stochastics in the overbought area, suggest that the bullish action may be running out of steam.

If the price retreats, the resistance trendline should turn a support area to verify the significance of its upward violation. Failure to hold above the line would shift attention to the 109.00 level where the upper surface of the Ichimoku cloud is currently placed, while below 108.40, which is the 50% Fibonacci of the 112.39-104.44 downleg, more losses could follow probably towards the 107.80 barrier and the 38.2% Fibonacci of 107.48.

Otherwise, a rebound near the previous high of 109.70 and a decisive rally above 110.00 would concrete the medium-term upward pattern off the 34-month low of 104.44, letting resistance move up to 110.70, whilst a steeper upside could also test the 111.40 mark ahead of the 112.39 top.

Summarizing, USDJPY is likely to remain muted in the short-term if the 110.00 keeps exerting downside pressure and positive in the medium-term if it manages to hold above 109.70.