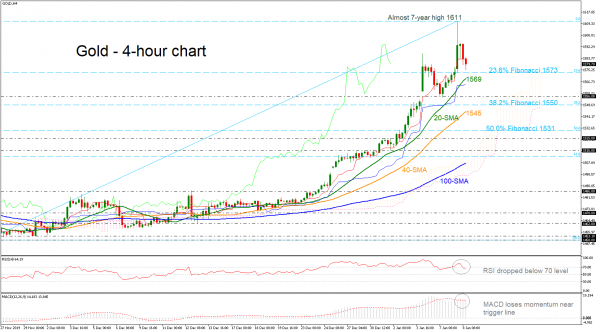

Gold looks to be overbought as it returns the significant gains that it posted in the preceding days. Earlier today, the price jumped to a fresh almost seven-year high of 1,611.

The technical indicators seem to be overstretched in the 4-hour chart. The RSI slipped below the oversold area and the 70 level and continues to slope down, while the MACD fell beneath the trigger line but is still moving in the positive zone. Both are indicating a possible downside correction after the strong upside rally. Also, the price was capped by the red Tenkan-sen line in the last session.

Immediate support to further losses would likely come from the 23.6% Fibonacci retracement level of the upleg from 1,450 to 1,611, around 1,573. Marginally below this level the 20-period simple moving average (SMA) could attract traders’ attention before the 1,556 support area, taken from the latest bottom.

To the upside, the next resistance is coming from the fresh high of 1,611. If there is a successful attempt above this hurdle, the focus could turn on the 1,700 psychological mark.

In the very short-term, the yellow metal may start a downside correction after the aggressive upside pressure.