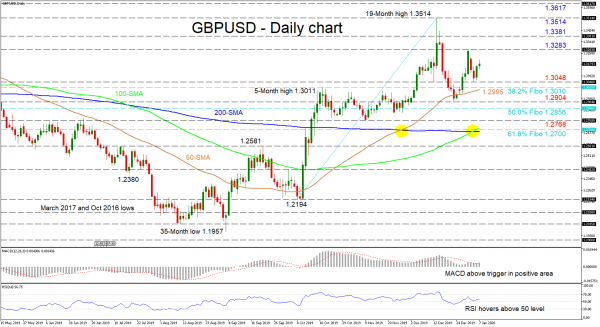

GBPUSD looks to be undecided with its recent lower highs and higher lows. That said, buyers are attempting to drive the pair back up in efforts to realign with the bigger positive outlook.

The short-term oscillators suggest a stall in directional momentum but lean towards the positive picture. The MACD, in the positive zone is marginally above its red trigger line, while the RSI is rising, slightly above its neutral mark. Noteworthy, are the upward sloping simple moving averages (SMAs) and the recent bullish crossover of the 200-day SMA by the 100-day one, which are backing a positive view.

If buyers retake control, first to prevent the push up could be the 1.3283 nearby high. Forcing above this, the 1.3381 peak, taken from back in March 2019 could obstruct buyers in reaching the 19-month high of 1.3514. Pursuing the climb, could see the peak of 1.3514 challenge the bulls’ attempts towards the next high from May of 2018 at 1.3617.

Alternatively, sellers would require a more sustained push to steer below the congested area of 1.3048, which encompasses the fresh low and the 50-day SMA of 1.2995. Also, the 38.2% Fibonacci retracement of the up leg from 1.2194 to 1.3514, of 1.3010 holds between the previous zone. Moving down, the swing low of 1.2904 and the 50.0% Fibo of 1.2856 underneath could impede further declines towards the 1.2768 trough. Driving below these marks, another tough support area at the 61.8% Fibo of 1.2700, where the completed bullish cross lies could be a major obstacle.

In brief, the short-term bias is neutral-to-bullish above 1.3010, while a break below the 1.2700 psychological number could see a bearish bias unfold.