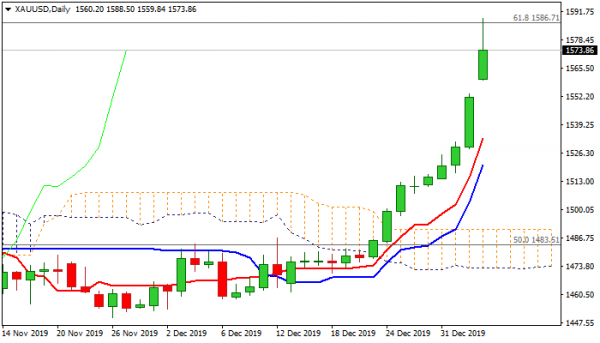

Spot gold opened with gap-higher and spiked to new nearly seven-year high at $1588 in early Asian trading on Monday. Rising tensions in the Middle East after the United States killed top Iranian general, further boosted demand for safe-haven yellow metal, which advanced 3.5% in past four weeks and was up 1.8% in early Monday’s trading. Risk of further escalation, as both sides threaten of new actions, Iran to retaliate and the US of direct attack, keep traders at high alert and further rise of gold price can be anticipated in such conditions. The gold price is currently riding on the fifth wave of five-wave cycle from $1160 (Aug 2018 low), which could, according to wave principles, extend to $1630 zone (also near Fibo 161.8% extension of bull-leg from $1445). Fresh advance today cracked important Fibo barrier at $1586 (61.8% of $1920/$1046, 2011/2015 descend) but faces headwinds here and may hold in extended consolidation before resuming higher. Strongly overbought daily studies support scenario, with dip-buying remaining favored scenario. Former high at $1557 (4 Sep) marks initial support and so far holding, with extended dips to find ground at $1535 zone (24 Sep lower high / Fibo 38.2% of $1445/$1588 upleg / rising daily Tenkan-sen) and keep bulls intact. Close above cracked Fibo barrier $1586 would generate fresh bullish signal for attack at psychological $1600 barrier (also Fibo 138.2% projection of the upleg from $1445) which guards $1630 target zone).

Res: 1588, 1600, 1616, 1630

Sup: 1559, 1557, 1553, 1535