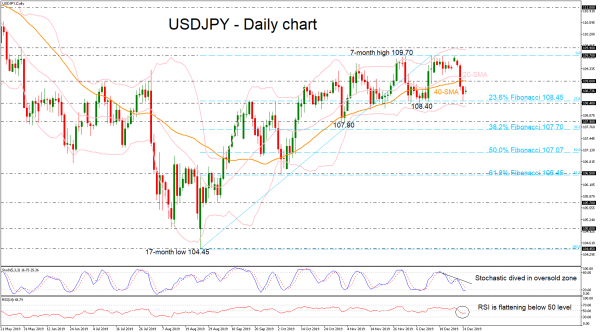

USDJPY remains under pressure and risk is still to the downside as prices continue to drift lower after the bounce off the 109.70 resistance level, remaining within the Bollinger bands. The short-term technical indicators are bearish and moving in the negative territory. The stochastic dived in the oversold zone and continues to point down, while the RSI is moving sideways, suggesting a neutral to bearish view.

The next target to the downside is the immediate support of the 23.6% Fibonacci mark of the upleg from 104.45 to 109.70 near 108.45 again. A drop below this significant region and the lower Bollinger band would open the way for the 107.90 barrier and the 38.2% Fibo of 107.70.

Upside moves are likely to find resistance at the 109.00 psychological mark, which overlaps with the 40-day simple moving averages (SMA). If the price surpasses the moving averages could, it could touch the seven-month high of 109.70.

Currently, the pair seems to be neutral in the short term, however, a daily close above the aforementioned obstacle could endorse the outlook for more upside movements.