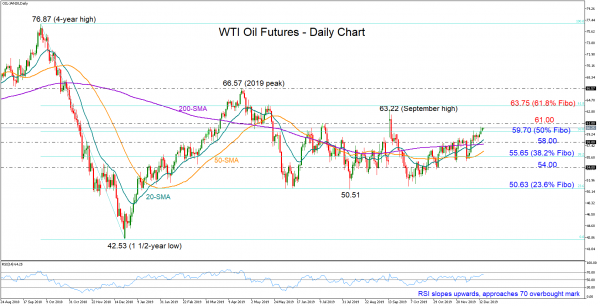

WTI oil futures for January delivery continued their upside trajectory on top of the 60 level and closed marginally above the 50% Fibonacci of the 76.87-42.53 bearish wave on Monday.

The location of the RSI, which maintains a positive slope comfortably above its 50 neutral mark, keeps the short-term bias in bullish territory. However, with the indicator approaching its 70 overbought mark, a slowdown in the price’s positive momentum cannot be ruled out.

With the focus being mostly on the upside, traders will be eagerly waiting for a decisive rally above the 61.00 barrier that could shift resistance up to September’s high and the 61.8% Fibonacci of 63.75. Should the bulls overcome that obstacle, the way would open for the 2019 peak of 66.57, where any break higher would reactivate the upward pattern started from the 42.53 bottom and put the market on a broader uptrend.

A downside reversal below the 50% Fibonacci of 59.70 could initially stall near the 20-day simple moving average (SMA) and the 58.00 resistance-turned-support mark. Breaching that floor, the 38.2% Fibonacci of 55.65 could come in defense to deter steeper declines towards the tougher 23.6% Fibonacci support of 50.63. Still, a closing price below 54.00 could confirm that the latter will likely happen.

As regards the medium-term picture, the outlook remains neutral within the 66.57 and 50.51 boundaries and any break of these edges is expected to adjust the sentiment accordingly.

Summarizing, WTI oil futures may gain additional positive traction in the short-term, though room for improvement seems to be narrowing. In the medium-term window, the commodity is in neutral mode.