Key Highlights

- GBP/USD started a strong increase from well below 1.3000.

- The pair surpassed many resistances near 1.3100, 1.3120 and 1.3150.

- EUR/USD is holding the key 1.1040 support area.

- The UK GDP could grow 0.1% in Oct 2019 (MoM).

GBP/USD Technical Analysis

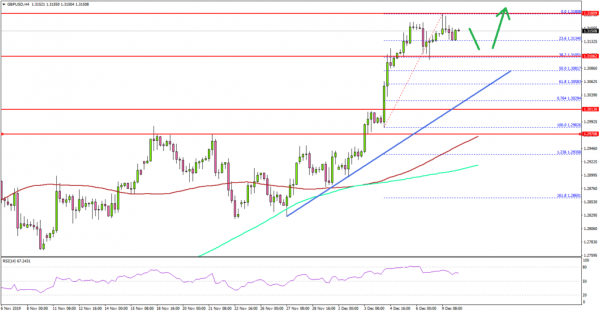

After forming support near 1.2850, the British Pound started a strong rally against the US Dollar. GBP/USD broke many resistances near 1.3000, 1.3050 and 1.3100 to move into an uptrend.

Looking at the 4-hours chart, the pair even settled above 1.3100 and the 100 simple moving average (red). It opened the doors for more gains above 1.3150.

The pair traded as high as 1.3180 and recently corrected lower. It tested the 23.6% Fib retracement level of the upward move from the 1.2982 low to 1.3180 high.

However, there are many supports on the downside near the 1.3150 and 1.3140 levels. Moreover, there is a key bullish trend line forming with support near 1.3080 on the same chart.

Besides, the 50% Fib retracement level of the upward move from the 1.2982 low to 1.3180 high is near the 1.3080 level. Therefore, dips remain well supported near 1.3150 and 1.3100.

On the upside, the pair is facing resistance near 1.3180 and 1.3200, above which there are chances of a strong rise towards the 1.3240 and 1.3260 levels in the near term.

Looking at EUR/USD, the pair is trading above the 1.1040 and 1.1050 support levels, and it could start a decent recovery above 1.1100.

Upcoming Economic Releases

- UK Industrial Production for Oct 2019 (MoM) – Forecast +0.2%, versus -0.3% previous.

- UK Manufacturing Production for Oct 2019 (MoM) – Forecast 0%, versus -0.4% previous.

- UK GDP for Oct 2019 (MoM) – Forecast +0.1%, versus -0.1% previous.

- German ZEW Economic Sentiment Index for Dec 2019 – Forecast 0, versus -2.1 previous.