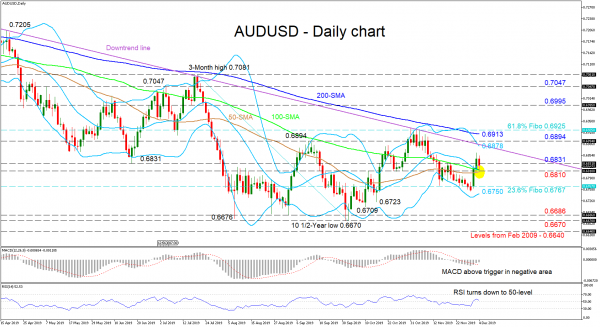

AUDUSD seems to be turning neutral – in a bigger negative picture – as it nears the downtrend line drawn from December 4. The price is currently resting at the 0.6810 point where the mid-Bollinger band, 50- and 100-day simple moving averages (SMAs) have converged, suggesting that the price may linger sideways to encounter the downtrend line.

Further backing the undecided picture are the mixed signals from the SMAs and short-term oscillators. The MACD, in the negative zone has moved above its red trigger line, while the RSI, in bullish territory, has dropped towards its neutral mark.

To the downside, immediate support comes from the fortified 0.6810 level, where the SMAs have come together. If sellers manage to dive below, the price may revisit the 0.6767 barrier – which is the 23.6% Fibonacci retracement of the down leg from 0.7081 to 0.6670 – and neighboring 0.6750 level, where the recent low and lower-Bollinger band are located. Steering lower, the swing lows of 0.6723 and 0.6709 could halt further declines towards the 0.6686 support and multi-year low of 0.6670.

Otherwise, if buyers push above 0.6831, the next tough resistance could come from the 0.6878 upper-Bollinger band area, where the downtrend line also resides. Slightly above, a more determined push from the bulls would be required to overcome the region of 0.6894 to 0.6925 – which also encompasses the 200-day SMA and the 61.8% Fibo – in order to turn the bias to a more positive one.

Summarizing, the short-term bias looks neutral. However, the longer the price remains below the downtrend line, the more likely that the negative sentiment will overpower.