WTI oil price is up 1.5% on Monday, recovering after last Friday’s 5% drop (the biggest one-day fall since 17 Sep).

Oil was hit by fears that trade talks would be disrupted and conflict would escalate, following US support to Hong Kong protesters last week that sparked strong sell-off on Friday.

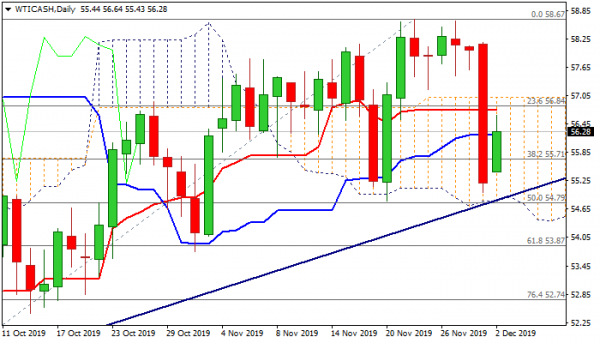

Strong fall after repeated failures to clearly break above key Fibo barrier at $58.46 (61.8% of $63.12/$50.91) shifted near-term focus lower, as Friday’s strong bearish acceleration surged through thick daily cloud (spanned between $57.02 and $54.82) and pressured cloud base, but failed to break below. Today’s recovery was supported by upbeat China’s manufacturing data which boosted expectations for increased energy demand from the second biggest world’s economy. Markets maintain hopes that OPEC would increase its current production cut that would tighten global oil supply.

The cartel and its close associates will meet later this week to discuss these matters.

Near-term action is weighed by Friday’s massive bearish daily candle, with Friday’s close below pivotal Fibo support at $55.71 (38.2% of $50.91/$58.67) adding to negative near-term tone, which is expected to persist while recovery attempts remain capped by daily cloud top ($57.02).

Fading bearish momentum on daily chart helps recovery, but recovery so far lacks strength to break above daily cloud top and signal reversal. Conversely, firm break below daily cloud base ($54.82), reinforced by bull-trendline off $50.91 low, would generate strong negative signal for extension of pullback from $58.67 (22 Nov high).

Res: 56.64; 56.75; 57.02; 57.54

Sup: 55.71; 55.43; 55.00; 54.82