The Aussie jumps in early Monday’s trading, supported by upbeat Chinese data (Caixin Manufacturing PMI Nov 51.8 vs 51.4 f/c) which showed that Chinese factory activity expands at the fastest pace in three years.

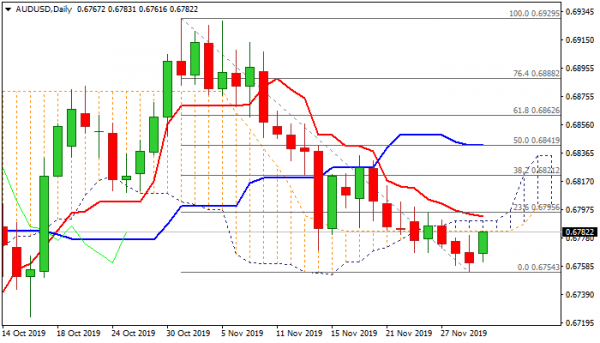

Fresh recovery sidelined larger bears which registered repeated closes below important technical supports (daily cloud / Fibo 61.8% of 0.6929/0.6754) that was strong bearish signal.

Bounce above broken Fibo support (0.6796) pressures daily cloud base (0.6782), with break above thin cloud (0.6782/90), reinforced by falling daily Tenkan-sen (0.6792) needed to generate initial bullish signal for stronger recovery.

Daily momentum heads north (although still in the negative territory) and stochastic emerged from oversold zone after forming bullish divergence that adds to supportive factors.

Break and close above daily cloud would expose next pivotal barrier at 0.6821 (Fibo 38.2% of 0.6929/0.6754) break of which is needed to signal reversal.

Caution on recovery stall under 0.6821 which would signal positioning for extension of larger downtrend from 0.6929 (31 Oct high) towards targets at 0.6731/10 (Fibo 76.4% / 10 Oct trough).

Res: 0.6790, 0.6800, 0.6821, 0.6841

Sup: 0.6796, 0.6761, 0.6754, 0.6731