Key Highlights

- USD/JPY is holding the key 108.25 and 108.20 support levels.

- A crucial resistance is forming near 108.80 and a bearish trend line on the 4-hours chart.

- The US Initial Jobless Claims for the week ending Nov 16, 2019 came in at 227K vs 219K forecast.

- The US Manufacturing PMI could increase from 51.3 to 51.5 in Nov 2019 (Prelim).

USD/JPY Technical Analysis

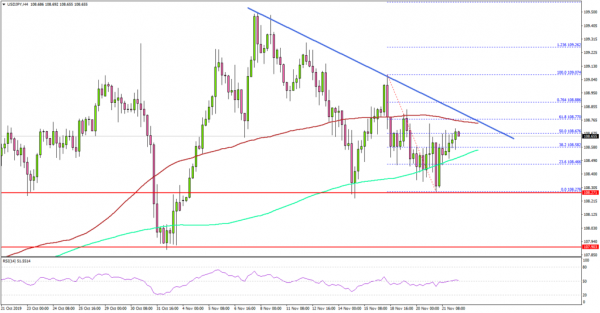

Recently, the US Dollar reacted to the downside from the 109.00 resistance against the Japanese Yen. The USD/JPY pair failed to hold the 108.80 support and revisited the 108.25 support area.

Looking at the 4-hours chart, the pair settled below the 108.80 level and the 100 simple moving average (red, 4-hours). The recent low was near 108.27 and the pair corrected above 108.50.

The pair tested the 50% Fib retracement level of the downward move from the 109.07 high to 108.27 low. However, there is a strong resistance forming near 108.80 and a bearish trend line.

Besides, the 61.8% Fib retracement level of the downward move from the 109.07 high to 108.27 low, and the 100 simple moving average (red, 4-hours) are near the 108.80 area.

Therefore, a clear break above the 108.80 resistance could open the doors for another increase. The next key resistances are near the 109.08 and 109.20 levels.

Conversely, USD/JPY could decline and break the 108.25 and 108.20 support levels. In the mentioned case, the pair is likely to continue lower towards the 107.90 and 107.60 levels.

Fundamentally, the US Initial Jobless Claims figure for the week ending Nov 16, 2019 was released by the US Department of Labor. The market was looking for a decline in claims from the last reading of 225K to 219K.

However, the actual result was negative as the US Initial Jobless Claims came in at 227K. Besides, the last reading was revised up from 225K to 227K.

The report added:

The 4-week moving average was 221,000, an increase of 3,500 from the previous week’s revised average. The previous week’s average was revised up by 500 from 217,000 to 217,500.

Overall, USD/JPY is liking approaching the next break either above 108.80 or below 108.20. Looking at EUR/USD and GBP/USD, both are trading nicely in a positive zone.

Upcoming Economic Releases

- Germany’s Manufacturing PMI for Nov 2019 (Preliminary) – Forecast 42.9, versus 42.1 previous.

- Germany’s Services PMI for Nov 2019 (Preliminary) – Forecast 52.0, versus 51.6 previous.

- Euro Zone Manufacturing PMI Nov 2019 (Preliminary) – Forecast 46.4, versus 45.9 previous.

- Euro Zone Services PMI for Nov 2019 (Preliminary) – Forecast 52.5, versus 52.2 previous.

- UK Manufacturing PMI Nov 2019 (Preliminary) – Forecast 49.0, versus 49.6 previous.

- UK Services PMI for Nov 2019 (Preliminary) – Forecast 50.0, versus 50.0 previous.

- US Manufacturing PMI for Nov 2019 (Preliminary) – Forecast 51.5, versus 51.3 previous.

- US Services PMI for Nov 2019 (Preliminary) – Forecast 51.0, versus 50.6 previous.