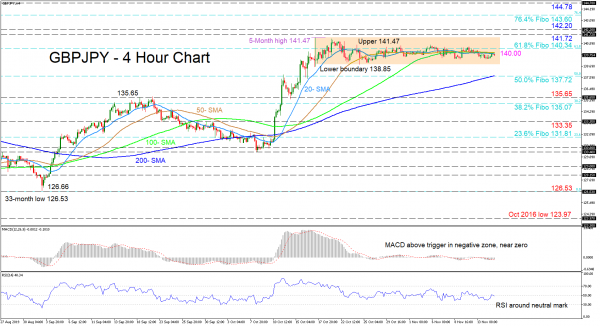

GBPJPY is currently below the 50-, 100- and 20-period simple moving averages (SMAs), having been bound within a trading range of 141.47 to 138.85 for almost a month. It is evident that directional momentum has evaporated, something also supported by the above mentioned SMAs which have joined and mostly adopted a horizontal bearing.

The technical indicators are showing mostly a position of neutrality as they are trading around their neutral marks. Currently the MACD is in the negative zone, slightly above its red trigger line and only just below zero, while the RSI is barely below its neutral point, showing a marginal improvement to the downside. Worth mentioning also is the 200-period SMA, which continues its ascent, which is something to keep in mind.

To the downside, the lower boundary of the range at 138.85 may come first ahead of a more durable obstacle at the 137.72 level, which is the 50.0% Fibonacci retracement of the down leg from 148.86 to 126.53 and where the 200-period SMA lies. Moving down, the swing low area of 135.65 could hinder the test of the nearby 38.2% Fibo of 135.07.

Otherwise, if buyers retake control and move above the SMAs, immediate resistance could be applied by the 61.8% Fibo of 140.34 before the upper band of 141.47 (five-month high) may be challenged. Then for the bulls to gain ground, they would need to breach the resistance levels above of 141.72 and 142.20, to extend the price to the 76.4% Fibo of 143.60.

In brief, the pair remains directionless in the short-term and a break either above 141.47 or below 138.85 would set the direction.