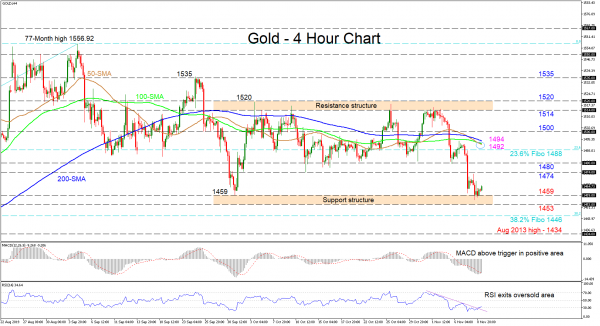

Gold rebounds off the support structure of 1459 – 1453 with buyers trying to push higher. The yellow metal deflected off the resistance structure of 1514 – 1520 last week and dropped underneath all simple moving averages (SMAs) and slightly below the 1459 trough of October 1. Furthermore, the downward slopes in the SMAs lean towards a negative outlook.

Yet, the short-term oscillators suggest that negative momentum is starting to weaken. The MACD, deep in the negative region, has just slipped above its red trigger line, while the RSI – which is ascending – has moved out of the oversold zone.

The 1459 – 1453 tough support area is currently controlling the market. If the bears manage to overcome this area, the 1446 level may then apply some upside pressure, being the 38.2% Fibonacci retracement of the up wave from 1266.20 to 1556.92. Further losses could then move the price to test the support coming from the high of August 2013 at 1434.

If buying interest picks up, the 1474 resistance could be the first to hinder the climb. Next, the 1480 level may test buyer’s determination ahead of the 23.6% Fibo of 1488, while neighboring SMAs currently at 1492 and 1494 could challenge the bulls further. Surpassing the SMAs, the psychological 1500 handle could be another tough obstacle to overtake before the 1515 – 1520 resistance zone bares its claws.

Overall, the short-term bias is looking neutral-to-bearish. A significant break either below 1453 or above 1520 would be needed to determine the next direction.