The Euro jumped in early European trading on Thursday after comment from China’s commerce ministry which expressed readiness to negotiate on how much tariffs can be cancelled.

The comment sparked fresh risk mode in the market and put near-term bears on hold, but near-term action remains biased lower.

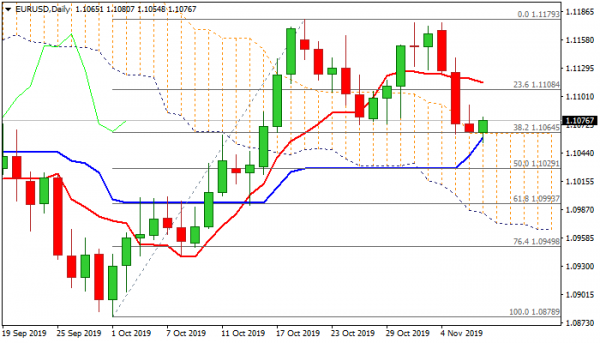

Today’s probe through strong support at 1.1064 (daily cloud top / Fibo 38.2% of 1.0878/1.1179) which contained the action in past two days, was bearish signal which requires confirmation on close below the support.

Clear break of 1.1064 pivot would expose supports at 1.1043/29 (55DMA / Fibo 50%) and risk acceleration towards 1.1000/1.0993 (psychological / Fibo 61.8% of 1.0878/1.1179) that would expose daily cloud base (1.0972).

Conflicting daily studies provide mixed signals but rising bearish momentum keeps the downside in focus.

Converging 20/10DMA’s (1.1101/10) in attempt to create bear-cross, are expected to cap upticks and keep bears in play.

Res: 1.1092, 1.1101, 1.1110, 1.1140

Sup: 1.1064, 1.1054, 1.1043, 1.1029