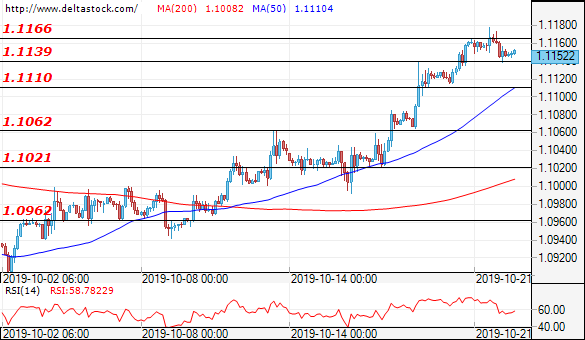

EUR/USD

Current level – 1.1152

The consolidation below the resistance zone at 1.1166 continues. A successful breakthrough at this level should increase positive momentum and lead the pair towards a test of the next resistance zone at 1.1240. In downward direction, the minor support is at 1.1140 and if broken, could draw a more bearish picture for a test of the next support zone around 1.1110 and then at 1.1060. The main factors behind price action should remain the news around Brexit, accompanied by the expected data on the European Central Bank interest rate decision this week.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.1170 | 1.1240 | 1.1110 | 1.0960 |

| 1.1200 | 1.1270 | 1.1062 | 1.0880 |

USD/JPY

Current level – 108.65

The currency pair continues its upward move after overcoming the corrective phase from the past days. The main resistance is at 108.90, as a break in this zone could be the reason for a rise and a test of the next resistance around 109.50. In downward direction, the main support level is at 108.15.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 108.90 | 109.00 | 108.15 | 107.40 |

| 109.20 | 109.30 | 107.80 | 107.00 |

GBP/USD

Current level – 1.2970

Positive outcome from Johnson’s efforts to fast-track the Brexit bill (volatility is expected around 19:00 UK time) should have a positive impact on the Cable should the bill passes. Expectations are for a break through the resistance level at 1.2990 and an attack on the next major resistance zone at 1.3180, followed by 1.3300 if the British PM is successful. The first major support level is at 1.2770.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.2990 | 1.3180 | 1.2880 | 1.2560 |

| 1.3046 | 1.3300 | 1.2780 | 1.2400 |