Key Highlights

- EUR/USD surged above the key 1.1080 and 1.1150 resistance levels.

- GBP/USD rallied towards the main 1.3000 resistance area.

- China’s GDP grew 6% in Q3 2019 (YoY) (lowest level since 1992).

- The German PPI could decline 0.1% in Sep 2019 (MoM), less than the last -0.5%.

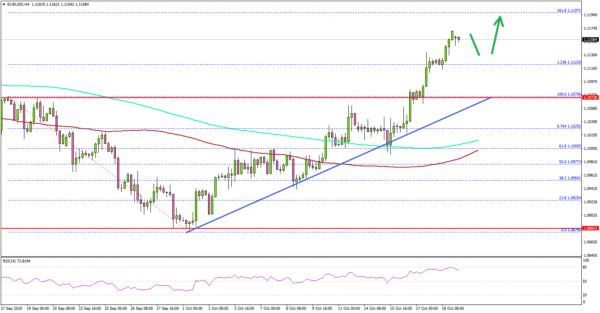

EUR/USD Technical Analysis

This past week, the Euro saw a sharp rise after it broke the key 1.1000 resistance area against the US Dollar. As a result, EUR/USD surged above many important hurdles, including 1.1050, 1.1050 and 1.1100.

Looking at the 4-hours chart, the pair gained bullish momentum after it broke the key 1.1080 resistance. The pair even settled above 1.1100 and it is now trading well above the 100 simple moving average (red, 4-hours).

More importantly, there was a break above the 1.236 Fib extension level of the downward move from the 1.1075 high to 1.0879 low. The current price action is positive and it seems like the pair could continue to rise towards 1.1200 and 1.1240 levels.

An immediate resistance is near the 1.618 Fib extension level of the downward move from the 1.1075 high to 1.0879 low.

If there is a downside correction, an initial support is near the 1.1140 level. The main support is near the 1.1080 level (the previous breakout resistance), where the bulls are likely to protect losses.

Fundamentally, the Chinese Gross Domestic Product (GDP) report for Q3 2019 was released by the National Bureau of Statistics of China. The market was looking for a 6.1% rise in the GDP compared with the same quarter a year ago.

However, the actual result was disappointing, as the GDP grew 6% in Q3 2019 (YoY) (lowest level since 1992). Looking at the quarterly change, there was a 1.5% rise, similar to the forecast, but less than the last 1.6%.

Overall, both EUR/USD and GBP/USD are showing bullish signs and they are likely to continue higher in the coming days.

Upcoming Economic Releases

- German Producer Price Index for Sep 2019 (MoM) – Forecast -0.1%, versus -0.5% previous.

- German Producer Price Index for Sep 2019 (YoY) – Forecast -0.3%, versus +0.3% previous.