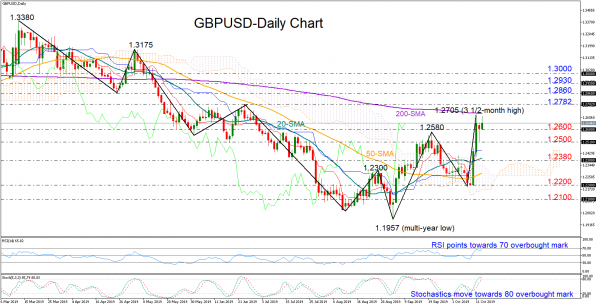

GBPUSD traders turned indecisive following last week’s impressive rally that drove the price slightly above the 1.2700 level and just below the 200-day simple moving average (SMA).

The short-term momentum indicators suggest a cautiously bullish bias as the RSI and the Stochastics maintain an upward direction not far below the overbought territory.

Regarding the market trend, however, technical signals are more optimistic since the pair has created a higher high around 1.2580 and a higher low at 1.2200, violating the downtrend started in mid-March. The bullish cross between the 20- and 50-day SMAs is also hinting that the upward tendency in the price may hold in the short-term.

Above the 200-day SMA, traders could look for resistance near the June 25 peak of 1.2782, while another leg up could retest the area between 1.2860 and 1.2930 before the spotlight shifts to the 1.3000 round level.

Alternatively, a closing price below 1.2600 could open the door for the 1.2500 mark, which if breached may bring more downside pressure towards 1.2380 taken from the lows on July 17. Beneath the latter, the next key support could be detected somewhere between 1.2200 and 1.2100.

Meanwhile in the three-month picture, the sentiment turned slightly positive after Friday’s rally. Should the 50-day SMA show an upward reversal more clearly , the odds for an outlook upgrade could increase.

Summarizing, GBPUSD buyers are expected to trade more cautiously in the short-term, while keeping the upward move 1.1957 in play.