GBP/USD surged above the 1.2500 and 1.2700 resistance levels to move into an uptrend. EUR/GBP declined heavily below the 0.8800 support and it is currently correcting losses.

Important Takeaways for GBP/USD and EUR/GBP

- The British Pound started a sharp rally above the 1.2400 and 1.2500 resistance levels.

- There is a connecting bullish trend line forming with support near 1.2530 on the hourly chart of GBP/USD.

- EUR/GBP is under a lot of pressure and is trading below the 0.8800 support area.

- There was a break below a major bullish trend line with support near 0.9000 on the hourly chart.

GBP/USD Technical Analysis

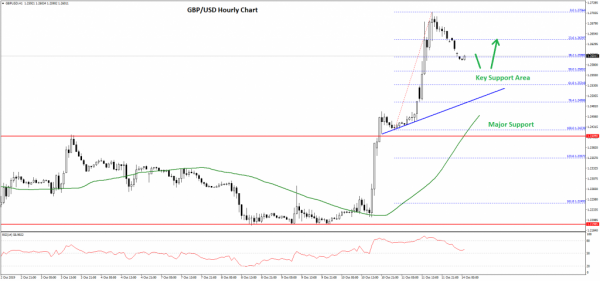

The British Pound formed a strong support base near the 1.2200 level against the US Dollar. The GBP/USD pair started a fresh increase and broke many key resistances near the 1.2400 and 1.2500 levels.

Moreover, there was a close above the 1.2500 resistance area and the 50 hourly simple moving average. The upward move was such that the pair even broke the 1.2650 and 1.2700 resistance levels. A new monthly high was formed near 1.2706 on FXOpen and the pair is currently correcting lower.

It is trading below the 1.2650 level and is testing the 38.2% Fib retracement level of the recent rally from the 1.2423 low to 1.2706 high near the 1.2600 level.

On the downside, there are many important supports near the 1.2565 and 1.2550 levels. Moreover, the 50% Fib retracement level of the recent rally from the 1.2423 low to 1.2706 high is also near the 1.2565 level to provide support.

More importantly, there is a connecting bullish trend line forming with support near 1.2530 on the hourly chart of GBP/USD. It coincides with the 61.8% Fib retracement level of the recent rally from the 1.2423 low to 1.2706 high.

Therefore, dips from the current levels towards the 1.2550 and 1.2530 levels are likely to find a strong buying interest. On the upside, an immediate resistance is near the 1.2650 level. The main resistance area is near the 1.2700 level.

EUR/GBP Technical Analysis

The Euro failed to remain stable above the 0.9000 pivot level against the British Pound. As a result, the EUR/GBP pair started a sharp decline and broke the main 0.9000 and 0.8900 support levels.

Moreover, there was a break below the 0.8800 support area and the 50 hourly simple moving average. It opened the doors for more downsides and the pair broke the 0.8750 support area.

A swing low was formed near 0.8695 and the pair is currently correcting higher. An immediate resistance is near the 0.8770 level. It coincides with the 23.6% Fib retracement level of the recent decline from the 0.9018 high to 0.8695 low.

The main resistance on the upside is near the 0.8800 and 0.8820 levels (the previous support). Moreover, the 50 hourly SMA is also positioned near the 0.8845 level.

Finally, the 50% Fib retracement level of the recent decline from the 0.9018 high to 0.8695 low is near the 0.8850 level. Therefore, there are many hurdles on the upside for the bulls near the 0.8800, 0.8820 and 0.8850 levels.

Any major correction in EUR/GBP might face a strong selling interest above the 0.8800 level. On the downside, the main supports are near the 0.8720 and 0.8700 levels.