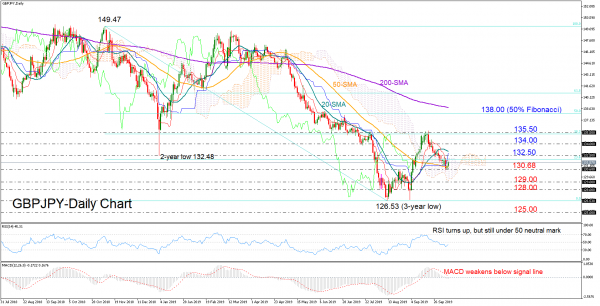

GBP/JPY bears turned busy around the key barrier of 130.68 this week, a break of which could put the rebound off 3-year lows in question.

A resumption of the negative momentum is possible according to the MACD which continues to strengthen under its red signal line, while the RSI needs to pierce above its 50 neutral mark to reduce downside risks.

Should 130.68 give up support, the spotlight will shift to the 128.00 mark once the 129.00 level is surpassed. Further down, the 3-year low of 126.53 could be a bigger challenge, which if violated could open the door for the 125.00 number.

In case the bulls retake control, leading the price above the 132.50, some consolidation could emerge around 134.00 before all attention turns to 135.50, where the 38.2% Fibonacci of the downleg from 149.47 to 126.53 is also placed.

Meanwhile in the three-month window, a rally above 135.50 would change the bearish outlook to neutral, while a closing price above the 50% Fibonacci of 138.00 would put the market back on the positive side.

In brief, GBPJPY could reactivate downside pressures under 130.68 in the short-term, while in the medium-term, the bearish outlook is expected to stay in play as long as the pair trades below 135.50.