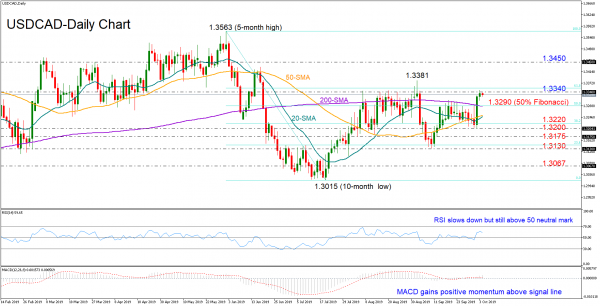

USD/CAD gathered strong bullish momentum on Wednesday and is currently trading near the key 1.3340 resistance level, which the bulls could not successfully overcome for more than three months now.

Technically there is more bullish fuel in store as the RSI has left the neutral territory and adopted an upward direction above 50, while the MACD is also picking up strength above its red signal line.

Questions however remain about whether the price can close decisively above the 1.3340 ceiling. If this is the case and the pair improves above that barrier, traders would like to see a rally above the 1.3381 peak on September 3, which also acted as a tough resistance on 2018, before turning attention to the 1.3450 handle.

Failure to breach 1.3340 and a decline under the 50% Fibonacci of 1.3290 and the 200-day simple moving average (SMA) would shift eyes back to the 1.3200 mark. Slightly lower, some consolidation is expected to emerge between 1.3175 and 1.3130, while further down the 1.3067 barrier may next take control.

Meanwhile in the medium-term picture, the pair is flatlining within the 1.3381 and 1.3015 boundaries and any violation at these edges is expected to provide fresh directional bias.

In brief, USDCAD is sending bullish short-term signals but only a climb above 1.3340 would attract additional buying interest. In the medium-term, a rally above 1.3381 is required to change the outlook from neutral to positive.