Key Highlights

- The Aussie Dollar traded to a new multi-year low against the US Dollar.

- AUD/USD is now facing resistance near 0.6730 and a bearish trend line on the 4-hours chart.

- The Reserve Bank of Australia reduced the interest rate from 1.0% to 0.75%.

- The US ISM Manufacturing Index declined from 49.1 to 47.8 in Sep 2019.

AUD/USD Technical Analysis

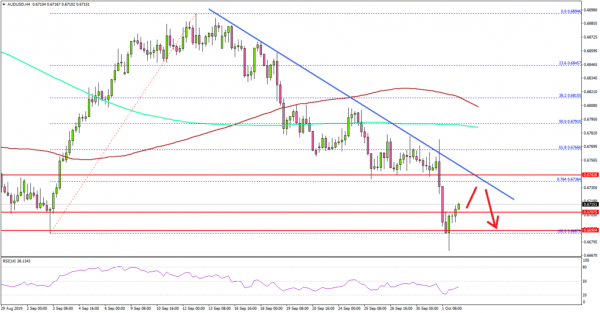

This month, there was a steady decline in the Aussie Dollar from well above 0.6800 against the US Dollar. However, AUD/USD accelerated its decline below the 0.6750 support after the RBA Board decided to lower the cash rate by 25 basis points to 0.75%.

Looking at the 4-hours chart, the pair declined heavily below the 0.6750, 0.6740 and 0.6730 support levels. Moreover, there was a break below the 0.6700 level and the pair settled well below the 100 simple moving average (red, 4-hours).

It traded to a new multi-year low below 0.6675 and it is currently trading in a strong downtrend. If there is an upside correction, the pair could face resistance near 0.6700.

The main resistance is near the 0.6730 level and a connecting bearish trend line on the same chart. To start a solid recovery, the pair must settle above the 0.6730 and 0.6750 resistance levels.

On the downside, the bears might target the 0.6640 level or the 1.236 Fib extension level of the last major upward move from the 0.6687 low to 0.6894 high. Any further downsides might push the pair towards 0.6600.

Fundamentally, the US ISM Manufacturing Index for Sep 2019 was released by the Institute for Supply Management (ISM). The market was looking for an increase from 49.1 to 50.1.

The actual result was disappointing, as the US ISM Manufacturing Index declined further to 47.8 in Sep 2019 and failed to register an expansion.

The report added:

The New Orders Index registered 47.3 percent, an increase of 0.1 percentage point from the August reading of 47.2 percent. The Production Index registered 47.3 percent, a 2.2-percentage point decrease compared to the August reading of 49.5 percent.

Overall, AUD/USD might correct in the short term, but it might struggle to break the 0.6730-0.6750 resistance area. Similarly, there could be a minor recovery in EUR/USD and GBP/USD.

Upcoming Economic Releases

- UK’s Construction PMI for Sep 2019 – Forecast 45.0, versus 45.0 previous.

- US ADP Employment Change Sep 2019 – Forecast 140K, versus 195K previous.