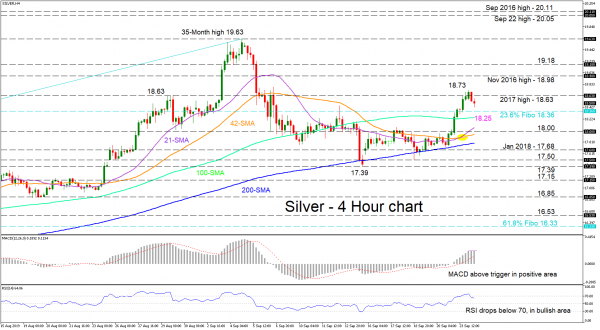

Silver’s bears resurfaced around the 2017 high of 18.63 after a rally which bounced off the 200-period simple moving average (SMA). The move up began once the price of the metal gapped back above the 200-period SMA, following a brief close beneath it on September 13.

The upward sloping 21- and 42-period SMAs indicate that the move up may stick around, with the 200-period SMA also backing the bigger positive outlook. That said, short-term oscillators paint a mixed picture, as the RSI has exited the overbought zone and is pointing down, while the MACD, despite being flat, still suggests that upside momentum remains on the table.

To the upside, if the 23.6% Fibo of 18.36 holds, or if the bulls reemerge and reverse the price above the 18.63 resistance, the 18.73 high could interrupt the move up to test the November 2016 peak of 18.98. Climbing higher, if the 19.18 resistance is overtaken, another rally could push to re-test the multi-year high of 19.63.

Moving lower, the bears would face the initial support at 18.36, which is the 23.6% Fibonacci of the up leg from 14.28 to 19.63, ahead of the 100-period SMA currently at 18.25. Dominating the 100-period SMA, the bears could tackle a tougher obstacle around the 18.00 handle, which is captured by the 21- and 42-period SMAs. Overcoming this could bring the 200-period SMA back into focus.

Summarizing, the medium-term positive sentiment remains. However, breaching the 19.63 level could revive a short-term bullish bias, while a close below 17.39 could turn it bearish.