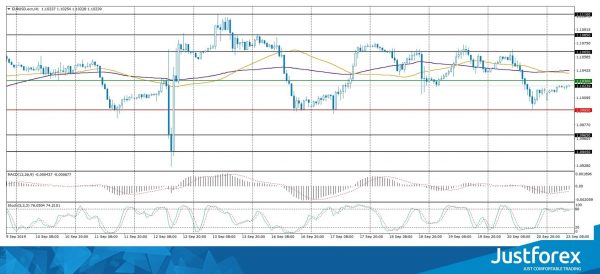

The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.10406

Open: 1.10068

% chg. over the last day: -0.21

Day’s range: 1.10068 – 1.10254

52 wk range: 1.0931 – 1.1817

The EUR/USD currency pair continues to trade in a protracted flat. The technical picture is still mixed. The trading instrument is currently consolidating. The local support and resistance levels are 1.09950 and 1.10300, respectively. Today, financial markets participants will evaluate a number of indicators of business activity in the eurozone. These statistics can have a significant impact on the dynamics of the single currency in the short term. We also recommend that you keep track of up-to-date information regarding trade negotiations between the US and China. Positions must be opened from key levels.

The Economic News Feed for 23.09.2019:

statistics on business activity in Germany and the eurozone – 10:30 (GMT+3:00) and 11:00 (GMT+3:00), respectively;

data on business activity in the USA – 16:45 (GMT+3:00).

Indicators of accurate signals do not give: 50 MA crossed 100 MA.

The MACD histogram is in the negative zone, but above the signal line, which gives a weak signal to sell EUR / USD.

The Stochastic Oscillator is in the neutral zone, the %K line crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.09950, 1.09650, 1.09450

Resistance levels: 1.10300, 1.10650, 1.10850

If the price consolidates above 1.10300, consider buying EUR/USD. The profits should be fixed at 1.10600-1.10800.

Alternatively, the quotes could decrease toward 1.09700-1.09500.

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.25217

Open: 1.24642

% chg. over the last day: -0.38

Day’s range: 1.24430 – 1.24907

52 wk range: 1.1995 – 1.3385

Last week, the pound reached three-month highs against the US dollar thanks to hopes that a hard Brexit could be avoided. European Commission President Jean-Claude Juncker said that the signing of the agreement between London and Brussels is still valid. At the moment, the GBP/USD currency pair has retreated from local highs. The trading instrument is consolidating in the range 1.24450-1.25000. In the near future, technical correction is not ruled out. We recommend opening positions from key levels.

The Economic News Feed for 23.09.2019 is calm.

Indicators do not provide accurate signals, the price crossed 50 MA and 100 MA.

The MACD histogram is in the negative zone and continues to decline, which indicates the correction of the GBP/USD currency pair.

The Stochastic Oscillator is in the neutral zone, the %K line is below the %D line, which also gives a signal to sell GBP/USD.

Trading recommendations

Support levels: 1.24450, 1.24000, 1.23650

Resistance levels: 1.25000, 1.25550, 1.25800

If the price consolidates below 1.24450, expect a correction toward 1.24000.

Alternatively, the quotes could grow toward 1.25400-1.25600.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.32627

Open: 1.32593

% chg. over the last day: -0.02

Day’s range: 1.32597 – 1.32776

52 wk range: 1.2727 – 1.3664

The technical picture on the USD/CAD currency pair is still ambiguous. CAD is trading in a long flat. At the moment, the following local support and resistance levels can be distinguished: 1.32550 and 1.32900, respectively. Participants in financial markets expect additional drivers. We recommend to pay attention to the dynamics of prices of oil. Positions must be opened from key levels.

At 15:30 (GMT+3:00), Canada will publish a report on wholesale sales.

Economic Event (CAD) – 00:00 (GMT+3:00);

Economic Event (CAD) – 00:00 (GMT+3:00);

Economic Event (CAD) – 00:00 (GMT+3:00);

Indicators do not give accurate signals,the price crossed 50 MA and 100 MA.

The MACD histogram is near 0.

The Stochastic Oscillator is in the neutral zone, the %K line is below the %D line, which gives a signal to sell USD/CAD.

Trading recommendations

Support levels: 1.32550, 1.32350, 1.32100

Resistance levels: 1.32900, 1.33150

If the price consolidates below 1.32550, expect the quotes to fall toward 1.32300-1.32100.

Alternatively, the quotes could grow toward 1.33200-1.33400.

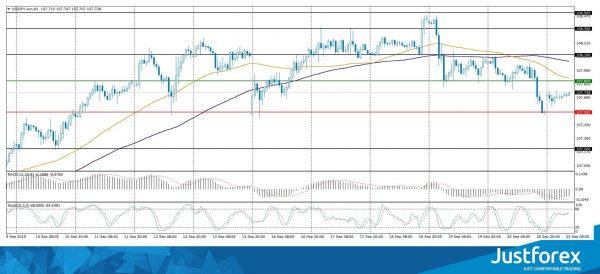

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 108.013

Open: 107.713

% chg. over the last day: -0.43

Day’s range: 107.607 – 107.753

52 wk range: 104.97 – 114.56

The USD/JPY currency pair went down. The trading tool has updated local lows. At the moment, the safe haven currency is consolidating. Quotes found support at 107.550. 107.850 is a mirror resistance. The USD/JPY currency pair has the potential for further correction after a protracted rally. We recommend that you pay attention to the dynamics of yield on US government bonds. Positions must be opened from key levels.

Today, Japanese financial markets are closed due to the holiday.

Economic Event (JPY) – 00:00 (GMT+3:00);

Economic Event (JPY) – 00:00 (GMT+3:00);

Economic Event (JPY) – 00:00 (GMT+3:00);

Indicators point to the strength of sellers: the price has fixed below 50 MA and 100 MA.

The MACD histogram is in the negative zone, but above the signal line, which gives a weak signal to sell USD/JPY.

The Stochastic Oscillator is in the neutral zone, the %K line crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 107.550, 107.200

Resistance levels: 107.850, 108.100, 108.350

If the price consolidates below 107.550, expect further correction toward 107.300-107.100.

Alternatively, the quotes could grow toward 108.100-108.300.