The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.09997

Open: 1.10718

% chg. over the last day: +0.66

Day’s range: 1.10515 – 1.10756

52 wk range: 1.0931 – 1.1817

Since the beginning of this week, trading on the EUR/USD currency pair has been very active. At the same time, there is no defined trend. Currently, EUR/USD quotes are consolidating. The local support and resistance levels are 1.10500 and 1.10750, respectively. Participants in financial markets took a wait and see attitude before the Fed meeting. The regulator is expected to reduce the key interest rate range by 25 basis points to 1.75% -2.00%. We recommend that you pay attention to the comments and rhetoric of representatives of the Central Bank. The Fed may indicate a further pace of monetary policy adjustment. Positions must be opened from key levels.

The Economic News Feed for 18.09.2019:

The consumer price index in the eurozone is 12:00 (GMT + 3: 00);

statistics on the real estate market in the USA – 15:30 (GMT + 3: 00);

decision on the Fed interest rate – 21:00 (GMT + 3: 00).

Indicators do not give accurate signals: 50 MA crossed 100 MA.

The MACD histogram is in the positive zone, but below the signal line, which gives a weak signal to buy EUR/USD.

Stochastic Oscillator is in the oversold zone, the %K line crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.10500, 1.10200, 1.09900

Resistance levels: 1.10750, 1.11100, 1.11300

If the price consolidates above the level of 1.10750, consider buying EUR/USD as the price rises to 1.11100-1.11400.

Alternatively, the quotes can decrease toward 1.1200-1.09900.

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.24248

Open: 1.24957

% chg. over the last day: +0.58

Day’s range: 1.24616 – 1.25064

52 wk range: 1.1995 – 1.3385

An ambiguous technical picture has developed on the GBP/USD currency pair. The trading instrument is currently consolidating. Pound is testing key extremes. The local support and resistance levels are: 1.24450 and 1.25000, respectively. Investors expect the Fed to decide on a key interest rate. We also recommend keeping track of up-to-date information regarding the Brexit process. In the near future, technical correction of GBP / USD quotes after a protracted rally is not ruled out. Positions must be opened from key levels.

At 11:30 (GMT+3:00) UK will publish an inflation report.

The price has fixed above 100 MA, which signals the strength of buyers.

The MACD histogram is in the positive zone, but below the signal line, which gives a weak signal to buy GBP/USD.

The Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which indicates bullish sentiment.

Trading recommendations

Support levels: 1.24450, 1.24000, 1.23650

Resistance levels: 1.25000, 1.25250

If the price consolidates above the round level of 1.25000, consider buying GBP/USD as the price moves toward 1.25500-1.25700.

Alternatively, it could decrease to 1.24000-1.23700.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.32392

Open: 1.32432

% chg. over the last day: +0.04

Day’s range: 1.32407 – 1.32674

52 wk range: 1.2727 – 1.3664

CAD continues to trade in a flat. There is no defined trend. At the moment, key support and resistance levels can be identified at 1.32350 and 1.32700, respectively. Investors are waiting for the Fed meeting and important economic releases from Canada and the United States. We also recommend monitoring the situation in the oil market. Positions must be opened from these marks.

At 15:30 (GMT+3:00) Canada will publish an inflation report.

Indicators point to the strength of buyers: the price has fixed above 50 MA and 100 MA.

The MACD histogram has started to rise again, indicating a bullish sentiment.

The Stochastic Oscillator is near the overbought zone, the %K line crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.32350, 1.32100, 1.31800

Resistance levels: 1.32700, 1.33000

If the price consolidates above 1.32700, expect further growth toward 1.33000-1.33200.

Alternatively, the quotes could drop toward 1.32000.

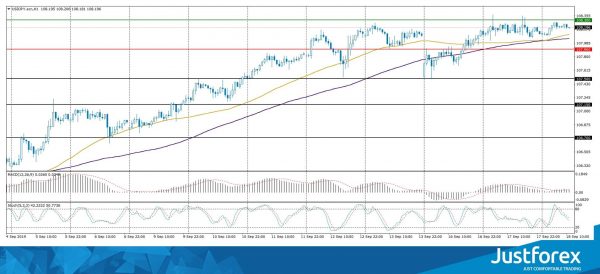

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 108.148

Open: 108.115

% chg. over the last day: -0.02

Day’s range: 108.086 – 108.273

52 wk range: 104.97 – 114.56

The USD/JPY currency pair is still in sideways movement. The technical picture is ambiguous. Participants in financial markets expect additional drivers. At the moment, the local support and resistance levels are: 107.900 and 108.300, respectively. In the near future, the correction of USD/JPY quotes after a long growth is not ruled out. We recommend that you pay attention to the dynamics of yield on US government bonds. Positions must be opened from key levels.

During the Asian trading session, Japan published an optimistic report on the trading balance.

Indicators do not give accurate signals: 50 MA crossed 100 MA.

The MACD histogram is in the positive zone, which signals a bullish mood.

The Stochastic Oscillator is in the neutral zone, the %K line is below the %D line, which gives a signal to sell USD/JPY.

Trading recommendations

Support levels: 107.900, 107.500, 107.150

Resistance levels: 108.300, 108.500

If the price consolidates below 107.900, expect a correction toward 107.500-107.200.

Alternatively, the quotes can grow toward 108.600-108.800.