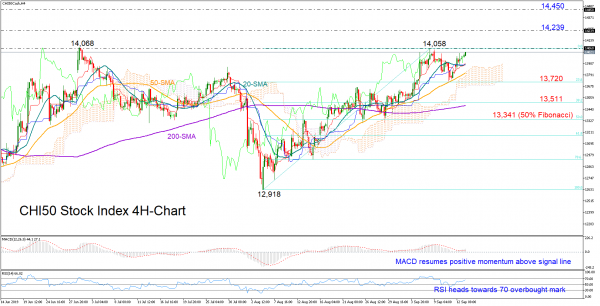

China’s 50 stock index (CHI50) made a U-turn near the 50-period simple moving average (SMA) in the four-hour chart and is building momentum to reclaim strong resistance around 14,060.

According to the RSI and the MACD there is more upside in store as both indicators point upwards in the bullish area, while in Ichimoku indicators, the red Tenkan-sen is ready to surpass the blue Kijun-sen line, embracing the positive spirit as well. It is also worth mentioning that the RSI approaches its 70 overbought mark and hence any improvement may be limited before a correction takes place.

Still, traders would like to see an impressive rally above 14,060 and more importantly on top of the 14,239 peak in order to place buying orders. If such a break happens, the bulls could gear towards the 14,450-14,632 area, where any decisive close higher would open the door for the all-time high of 14,914.

In case sellers take over, the 50-period SMA could ‘catch’ downside falls ahead of the 23.6% Fibonacci of 13,720 of the upleg from 12,918 to 14,058. Should the price slip confidently below the bottom of the Ichimoku cloud too, the bearish wave could stretch towards the 38.2% Fibonacci of 13,511 and the 200-period SMA.

Summarizing, the CHI50 index is likely to maintain bullish strength in the short-term, though only a significant upturn above 14,060 would significantly increase buying interest medium- and longer-term.