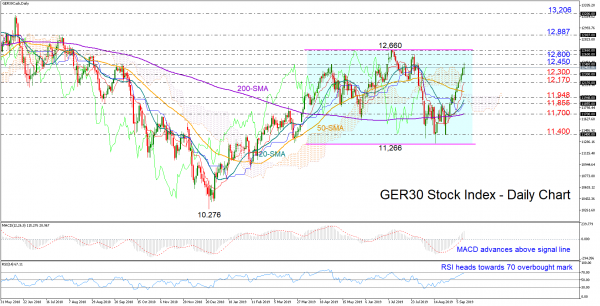

GER30 stock index had two constructive weeks and is completing another one above the Ichimoku cloud and its simple moving averages (SMAs) in the daily chart.

Technically, the market may run for more gains in the short-term as the MACD and the RSI strengthen to the upside in the positive area. The latter, however, should warrant some caution for bullish traders as the indicator is ready to crawl above its 70 overbought mark.

Above the 12,450 resistance level, the market would retest July’s peaks of 12,600 and 12,660, which if significantly violated would give a way for another upward move that may take a breather near 12,887. If the rally continues the next level to watch could be 13,206.

Should the bears take over, traders could look for immediate support around today’s troughs of 12,300 and Wednesday’s low of 12,170. Deeper, some consolidation is expected to emerge between 11,948 and 11,855, whilst a drop under 11,700 and the 200-day SMA may trigger a steeper sell-off towards 11,400.

In the medium-term window, the view is neutral within the 12,660 and 11,266 boundaries.

Summarizing, GER30 is cautiously bullish in the short-term and neutral in the medium-term.