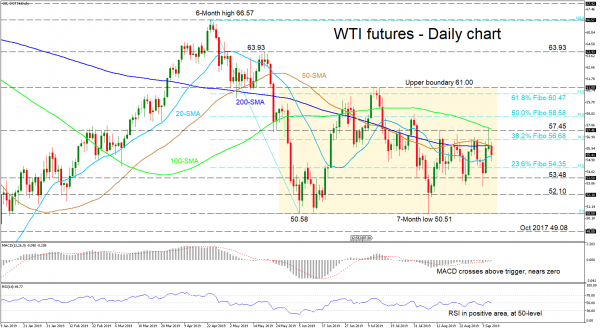

WTI oil futures rallied from a seven-month low on August 7, but the gains were halted at 56.68 and around the 38.2% Fibonacci retracement level of the down wave from 66.57 to 50.58. After multiple failed attempts to close above the 56.68 resistance level over the last couple of weeks, the 20-, 50- and 200-day simple moving averages (SMAs) have converged, encapsulating the price of the commodity. More importantly, the bull’s endeavor, to move above the downward sloping 100-day SMA was denied, something also reflected in the momentum indicators.

The MACD’s and RSI’s increasing positive momentum dried up, leaving the indicators stuck in the neutral zone.

If the 38.2% Fibo holds and the bears fracture the 20-day SMA, the price could come to rest somewhere between the 23.6% Fibo of 54.35 and the 53.48 support level. If selling persists the 52.10 barrier could provide some pressure, before a shove south to the lower boundary of 50.58 unfolds. Even lower, the 49.08 support from October 2017 could draw traders focus.

If the bulls surpass the 200-day SMA and more importantly the 57.45 resistance, the next stop could be around the 50.0% Fibo of 58.58. Further up, the 61.8% Fibo of 60.47 could draw attention ahead of the 61.00 handle.

Summarizing, the short-term outlook remains bleak as oil is held between the 57.45 and 53.48 levels. The pair could follow a new direction above or below those boundaries.