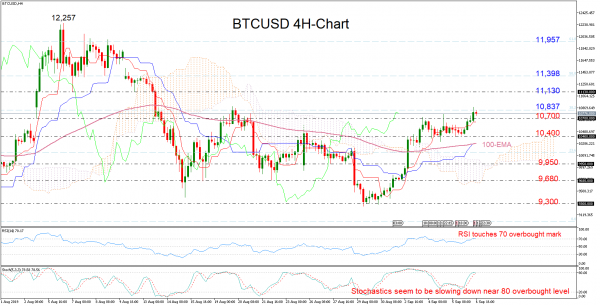

BTCUSD (Bitcoin) staged a stunning upside reversal around the 9,300 support area, with the price surging back above the 100-period exponential moving average (EMA) and towards two-week highs.

Buyers are currently pushing efforts to overcome the 38.2% Fibonacci of 10,837 of the downleg from 13,809 to 9.011, a break of which could see the retest of the 11,130 barrier. Moving higher, the 50% Fibonacci of 11,398 could next captivate trader’s attention and trigger another bullish action towards the 61.8% Fibonacci of 11,957.

Still, with the RSI and the Stochastics entering overbought waters, downside corrections cannot be ruled out. Particularly, if the 38.2% Fibonacci of 10,837 holds and sellers move below 10,700 the 10,400 number could come back into play. Further down, a cross under the 100-period EMA may open the way towards 9,950 taken from the inside swing lows at the end of August. Breaching the bottom of the Ichimoku cloud currently seen around 9,680, the bears would re-challenge the 9,300 support zone with scope to put the market back on a downtrend.