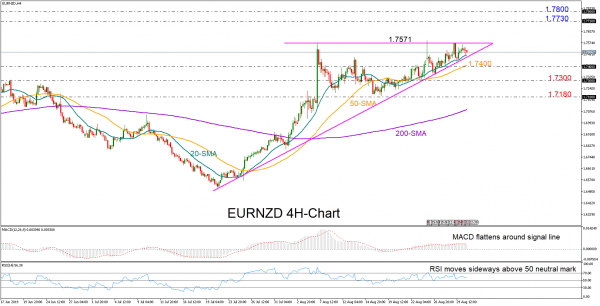

EURNZD is likely to extend the sideways move in the short-term until it completes the asymmetrical triangle in the four-hour chart, with the RSI and the MACD backing this view as well as the indicators are lacking clear direction.

The positive slope in the 20-period simple moving average (SMA) that recently crossed above the 50-period SMA suggests that the upward pattern will stay in place in the short-term.

Should the price crawl above the triangle and the 1.7571 ceiling, the market could attract fresh buying interest, with resistance running up to 1.7730. Slightly higher, a break of the 1.7800 key level would open the door for the 2018 top of 1.7926.

In the negative scenario, the market could slip below the triangle and the 20-period SMA to retest the 50-period SMA currently around 1.7400. Another leg lower could stretch towards the 1.7300 barrier, while deeper, a breach of the 1.7180 number would put an end to the range-bound trading and confirm the start of a downtrend.

Summarizing, EURNZD is expected to fill the asymmetrical triangle and then shift higher if the price keeps trading above its short-term SMAs.