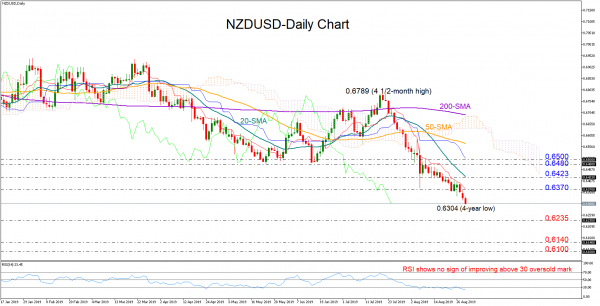

NZDUSD came under fresh sell-off on Thursday in the wake of downbeat business data, with the price stretching its two-year old downtrend to an almost four-year low of 0.6304.

Technical signals remain bearish.The Tenkan-sen line continues to move with a steep negative slope well under the blue Kijun-sen line, while the RSI shows no appetite of leaving the oversold territory, both flagging further weakness for the market.

A crucial support level is located at 0.6235, where the market bottomed in 2015. Any violation at this point could add more legs to the bearish move, sending the price probably towards the 0.6140-0.6100 area. Further down, the door would open for the 2006 low of 0.5928.

Should the market prove oversold, the price could correct to the upside to meet the Tenkan-sen line currently at 0.6370. Breaking higher and above 0.6423, where the 20-day simple moving average (SMA) lies at the moment, the bulls could get more fuel to reach the 0.6480-0.6500 region. A decisive close above the latter would put the market back into the neutral zone in the medium-term picture.

Overall, NZDUSD faces severe downside pressures and only a rally above 0.6500 would signal that the worst phase of the bearish mood is over.