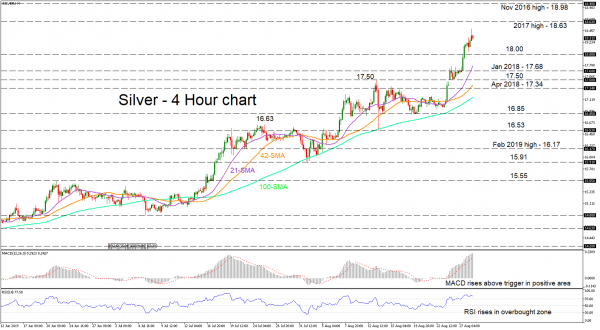

Silver has been in a three-month rally from May 28. The metal surpassed the highs from the first months of 2018 as well as the 18.00 psychological number.

The bulls continue to dominate, something also signaled by the momentum indicators’ bullish demeanor. The MACD is rising and distancing itself from its red trigger line in the positive territory, whilst the RSI despite moving further into the overbought region, has turned down. Although no clear reversal signals are apparent, caution for a short-term correction down is warranted by the RSI, as the price overstretches north.

If the metal manages to sustain the up climb above the 18.00 handle, resistance could come from 18.63 which is the high from 2017. Moving higher a more important barrier of 19.00, which is slightly higher than the November 2016 high of 18.98, may unfold.

To the downside, a pullback may see sellers find initial support at the 18.00 level, before encountering the 21-period simple moving average (SMA) ahead of the 17.68 support of January 2018. Falling lower the 17.50 level could apply some pressure before silver attempts to penetrate the durable support of 17.34 from April 2018, where the 42-period SMA also lies.

Summarizing, the short- and medium-term bullish bias prevails. For the picture to turn neutral, the bears would need to push below the swing low of 15.91.