Key Highlights

- Recently, the US Dollar retested the key 1.3345 resistance against the Canadian Dollar.

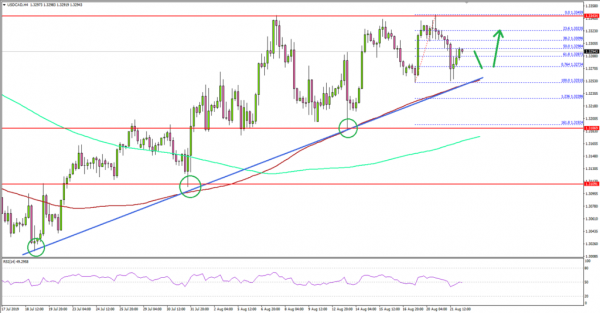

- A major bullish trend line is forming with support near 1.3240 on the 4-hours chart of USD/CAD.

- Canada’s CPI increased 0.5% in July 2019 (MoM), more than the +0.2% forecast.

- The US Manufacturing PMI could increase from 50.4 to 50.5 in August 2019 (Preliminary).

USD/CAD Technical Analysis

In the past few days, there was a steady rise in the US Dollar above 1.3200 against the Canadian Dollar. The USD/CAD pair climbed above the 1.3300 resistance, but it struggled to break the key 1.3345 resistance

Looking at the 4-hours chart, the pair failed on more than two occasions near the 1.3340-1.3350 area. The last swing high was near 1.3345 before the pair corrected lower.

There was a break below the 1.3300 support plus the 50% Fib retracement level of the upward move from the 1.3251 low to 1.3345 high. It opened the doors for more losses towards the 1.3251 swing low.

However, there are many supports on the downside near the 1.3240 and 1.3220 levels. Moreover, there is a major bullish trend line forming with support near 1.3240 on the same chart. The 100 simple moving average (red, 4-hours) is also following the trend line near 1.3240.

If there is a downside break below the trend line support, the pair could test the 1.3200 support level. An intermediate support is near the 1.236 Fib extension level of the upward move from the 1.3251 low to 1.3345 high.

On the upside, the main resistance is near the 1.3340 and 1.3350 levels. A successful break above 1.3350 could open the doors for a push towards the 1.3400 and 1.3420 levels.

Fundamentally, the Canadian Consumer Price Index (CPI) for July 2019 was released by the Statistics Canada. The market was looking for a 0.2% rise in the CPI compared with the previous month.

The actual result was well above the market forecast, as the CPI increased 0.5%. Looking at the yearly change, there was a 2.0% rise in the CPI, more than the 1.7% forecast, but similar to the last reading.

The report added:

Year-over-year growth in the services index slowed in July (+2.4%) compared with June (+2.8%). This slowdown was offset by an increase in the goods index (+1.3%), as the year-over-year decline in gasoline prices slowed and price growth increased for durable goods and food.

Overall, there could be a short term decline in USD/CAD, but as long as there is no daily close below 1.3200, the pair is likely to continue higher. Moreover, there are a few recovery signs emerged for both EUR/USD and GBP/USD in the past few sessions.

Economic Releases to Watch Today

- Germany’s Manufacturing PMI August 2019 (Preliminary) – Forecast 43.0, versus 43.2 previous.

- Germany’s Services PMI August 2019 (Preliminary) – Forecast 54.0, versus 54.5 previous.

- Euro Zone Manufacturing PMI August 2019 (Preliminary) – Forecast 46.2, versus 46.5 previous.

- Euro Zone Services PMI August 2019 (Preliminary) – Forecast 53.0, versus 53.2 previous.

- US Manufacturing PMI August 2019 (Preliminary) – Forecast 50.5, versus 50.4 previous.

- US Services PMI August 2019 (Preliminary) – Forecast 52.8, versus 53.0 previous.

- US Initial Jobless Claims – Forecast 216K, versus 220K previous.