‘I think the Fed will get a green light [to raise rates] unless a very bad [U.S.] jobs data comes out next week.’ – Yukio Ishizuki, Daiwa Securities (based on Reuters)

Pair’s Outlook

Expectations of the Fed raising rates in March caused the US Dollar to strengthen against a basket of currencies on Wednesday, particularly against the Yen. The US Dollar, however, was unable to reclaim the 114.00 level, although did try to do so. The bearish trend-line was pierced, which suggests that another rally today is likely, with the 114.60 area being the ceiling, as a number of significant levels form a strong resistance area there. Technical studies, on the other hand, are unable to confirm this outlook, as they keep giving mixed signals. Nevertheless, the base case scenario is a close above 114.00 today.

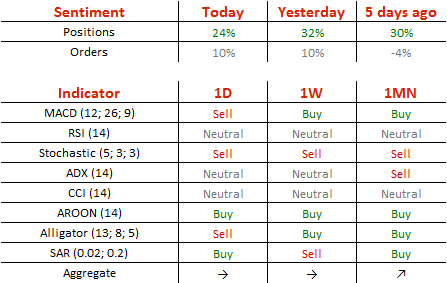

Traders’ Sentiment

Traders retain a positive outlook towards the Greenback, with 62% of all open positions being long (previously 66%). At the same time, the share of buy orders remains unchanged at 55%.