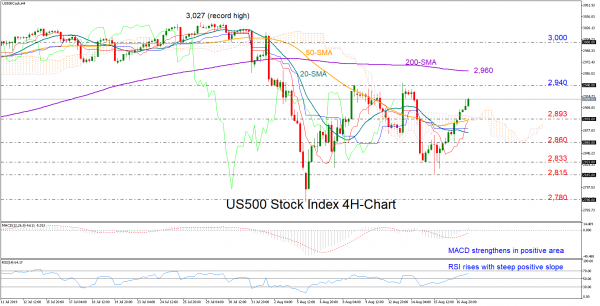

The US 500 stock index (cash) is looking increasingly positive in the short term, having surpassed its 50-period simple moving average (SMA) and the Ichimoku cloud and given the positive direction in the RSI and the MACD.

The bulls, however, may need to lift the index above the 2,940 barrier to confirm further upside, while a significant break above the 200-period SMA (2,960) may increase buying interest towards the 3,000 level.

Should the price retreat below the cloud, traders could search for immediate support around 2,860 and then near 2,833. A steeper decline could also retest the August 15 low of 2,815 before the spotlight turns to the 2,780-2,740 area, where any violation would put the December rally in serious consideration.

Summarizing, buyers may keep supporting the US500 stock index in the short-term, though only a climb above 2,940 may concrete the rebound from recent lows.