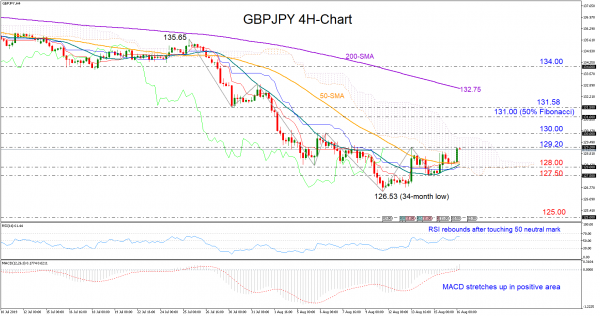

GBPJPY is showing bullish signals in the four-hour chart as the MACD is strengthening in the positive area and the RSI is resuming upside momentum above its 50 neutral level.

The pair has created a higher low around the 127.50 barrier but this is not enough for a complete violation of its downward pattern as the price also needs to post a higher high above its previous peak of 129.20. A forceful rally above 130.00, which coincides with the 38.2% Fibonacci of the upleg from 135.65 to 126.53, would lead the pair out of the cloud, providing more convincing signs that an uptrend is in progress. In such a case, the spotlight would shift to the 50% Fibonacci of 131.00 and more importantly to the July low of 131.38.

On the way down, the 20- and 50-period simple moving averages (SMA) currently around 128.00 could limit downside corrections before the focus turns to the 127.50 level. A close below the latter would put in doubt the recent rebound, sending support towards the 126.53 bottom. Deeper and under 126.00, the 125.00 number could be the next challenge.

In the bigger picture, the market remains strongly bearish and only an upturn above 134.00 would switch the outlook back to neutral. A closing price above the 200-period SMA could be the trigger point for an acceleration.