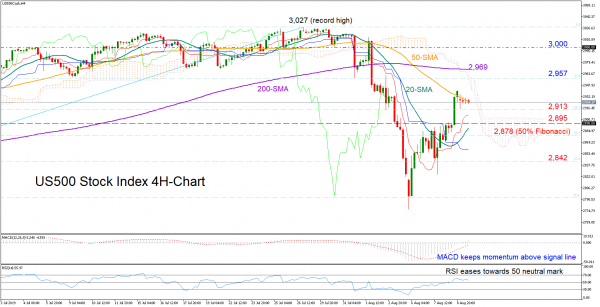

The US500 stock index managed to restore more than half of the losses it recorded after reaching a new record high last week, and even though it failed to hold above the 50-period simple moving average (SMA), the bullish forces have not fully faded yet.

The MACD continues to pick up strength in positive territory and comfortably above its signal line, the RSI continues to consolidate in bullish area, while in Ichimoku indicators, the red Tenkan-sen is flattening above the blue Kijun-sen, all framing a bullish-to-neutral picture for the short-term..

The 2,957 mark seems to be an ideal place to look for resistance if the price significantly surpasses the 50-period SMA, as this is approximately the point where the market changed direction several times in the past. This is also where the upper surface of the Ichimoku cloud meets the 23.6% Fibonacci extension of the 2,728-3,027 upward move. Higher, the bulls would aim to clear the 3,000 level and reach the all time high of 3,027, though the 200-period SMA should be breached first.

In case the index continues to lose momentum, the market could initially find some footing around the 38.2% Fibonacci of 2,913, while slightly lower a former restrictive zone near 2,895 could keep the bulls away from the 50% Fibonacci of 2,878. A steeper decline could also hit the 61.8% Fibonacci of 2,842.