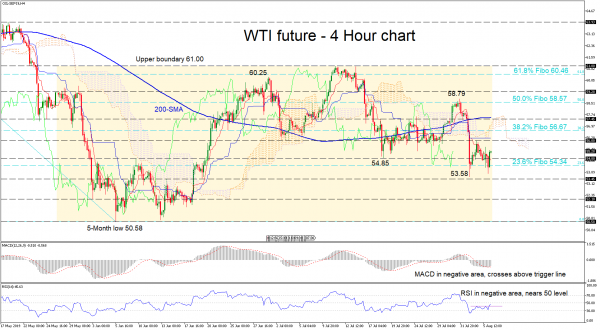

WTI oil futures fell from the 58.79 peak from the beginning of the month to a spike low of 53.58. Presently standing at 55.25, the price is trading between the 56.00 resistance and 53.45 support.

Although the Tenkan-sen is showing a downwards direction in the short-term, the Kinjun-sen has flattened over the recent period, with the sideways move suggesting some indecision present. The MACD has crossed above its red trigger line while in the negative region, whilst the RSI points up just a shy below its 50-neutral level.

On the downside, initial support could come between 54.80 and 54.34. If selling interest picks up, with the price exceeding these levels, the 53.45 swing low from June 19 could be tested and if surpassed bring the 52.10 support level into focus. Even lower, traders could look at 50.58 which is the lower boundary of the two-and-a-half month trading range.

If the support region of 54.80 – 54.34 holds, the price could head north to meet resistance from the 56.00 level. Surpassing the 38.2% Fibo retracement level of 56.67, of the down leg from 66.57 to 50.58, the oil price will have to push through the 57.45 obstacle to face the swing high of 58.79 slightly above the 50.0% Fibo of 58.57.

Overall, a break of the lower boundary would turn the short- and medium-term outlook to bearish. Only a break above the swing high of 58.79 could shift the bias to neutral again.