Key Highlights

- The US Dollar retreated sharply from the 2-month high at 109.31 against the Japanese Yen.

- Recently, USD/JPY traded below a major bullish trend line with support near 108.75 on the 4-hours chart.

- The US ISM Manufacturing Index in July 2019 declined from 51.7 to 51.2.

- The US nonfarm payrolls in July 2019 could increase 164K, less than the last 224K.

USDJPY Technical Analysis

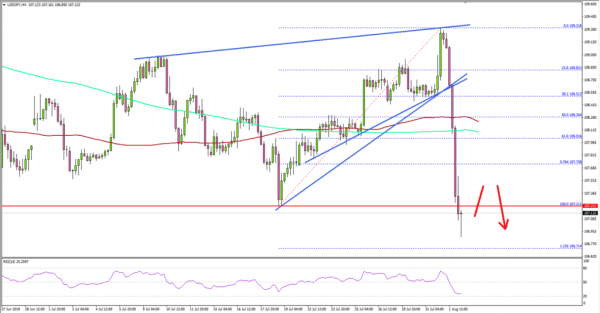

The US Dollar started a strong rise from the 107.20 level against the Japanese Yen. The USD/JPY pair climbed to a new 2-month high near 109.30 and recently declined heavily.

Looking at the 4-hours chart, the pair traded as high at 109.31 and recently started a major downward move. It broke the 109.00 support level plus the 50% Fib retracement level of the upward move from the 107.21 low to 109.31 high.

Moreover, the pair traded below a major bullish trend line with support near 108.75 on the same chart. It opened the doors for more losses below the 108.50 and 108.20 support levels.

The decline was such that the pair settled below 107.50, 100 simple moving average (red, 4-hours), and 200 simple moving average (green, 4-hours).

An immediate support is near 106.70 plus the 1.236 Fib extension level of the upward move from the 107.21 low to 109.31 high. Any further losses might push the pair below the 106.50 level. On the upside, an immediate resistance is near the 107.50, followed by 108.00.

If the pair struggles to stay above the 107.00 support, it could fail to correct higher in the coming sessions. In the mentioned case, the pair could even break the 106.50 support.

Fundamentally, the US ISM Manufacturing Index for July 2019 was released by the Institute for Supply Management (ISM). The market was looking for an increase from the last reading of 51.7 to 52.0.

The actual result was below the forecast, as there was a decrease in the US ISM Manufacturing Index from 51.7 to 51.2.

The report added that:

New Orders, Production, and Employment growing, Supplier Deliveries slowing at a faster rate; Backlog contracting, Raw Materials Inventories contracting; Customers’ Inventories too low, and prices decreasing; Exports and Imports contracting.

Overall, the US Dollar retreated sharply from highs against the Japanese Yen, but pairs such as EUR/USD and GBP/USD struggled to correct higher convincingly.

Economic Releases to Watch Today

- Euro Zone Retail Sales for June 2019 (MoM) – Forecast +0.2%, versus -0.3% previous.

- US nonfarm payrolls July 2019 – Forecast 164K, versus 224K previous.

- US Unemployment Rate July 2019 – Forecast 3.7%, versus 3.7% previous.