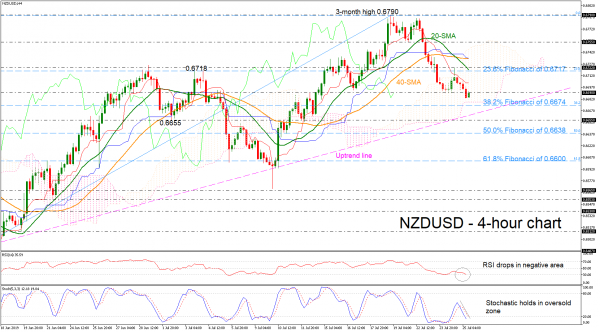

NZDUSD is on course for weekly losses, dropping into the Ichimoku cloud and creating a ten-day low around 0.6685.

The RSI in the 4-hour chart continues to drop in the bearish area, while the red Tenkan-sen keeps moving below the blue Kijun-sen line, increasing chances for a meaningful selling interest in the short-term trading. Also, the stochastic oscillator entered the oversold zone and is still heading lower.

Should the price edges down, the 38.2% Fibonacci retracement level of the upleg from 0.6487 to 0.6790 near 0.6674 could attract traders’ attention before touching the 0.6655 barrier, penetrating the ascending trend line to the downside.

In the alternative scenario, a jump above 0.6690 could reach the 23.6% Fibonacci of 0.6717 and the 0.6722 resistance level, which encapsulates the 20-simple moving average (SMA). More advances could send the pair until the 40-SMA currently at 0.6733.

Overall, NZDUSD is in the process of changing the outlook from positive to negative but first it needs to violate the 38.2% Fibo and the short-term uptrend line.