WTI oil price bounced from new two-week low at $56.20 on Thursday, boosted by renewed tensions in the Persian Gulf after Iran seized a foreign tanker in the strait of Hormuz.

Oil price was down nearly $5 in past few sessions, following double-rejection at $60.90 and subsequent acceleration lower on news that the US administration might begin talks with Iran.

Negative signals were boosted by weak API Crude stocks report data, while stronger EIA report on Wednesday showed stronger than expected draw in crude inventories that partially offset negative impact.

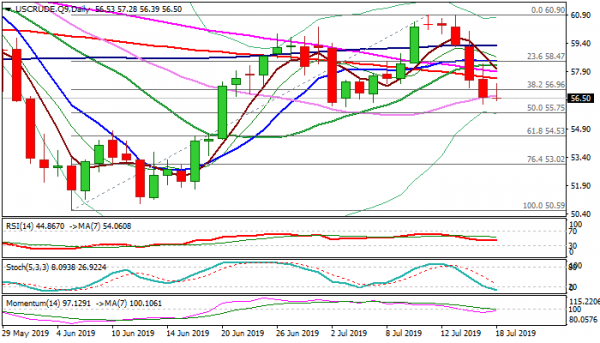

Bears are taking a breather ahead of strong supports at $56.04/$55.75 (3 July trough/50% retracement of $50.59/$60.90 ascend), but near-term action remains biased lower while holding below falling 200DMA ($57.55).

Firm break below $56.04/$57.55 pivots would signal extension of bear-leg from $60.90 and expose pivotal Fibo support at $54.53.

Initial bullish signal could be expected on close above 200SMA, however, further recovery signals would require lift above converged daily MA’s at $57.89/$58.44 zone.

Res: 57.28; 57.55; 57.89; 58.44

Sup: 56.39; 56.04; 55.75; 55.00