The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.12099

Open: 1.12239

% chg. over the last day: +0.12

Day’s range: 1.12238 – 1.12420

52 wk range: 1.1111 – 1.2009

Yesterday, the greenback weakened against a basket of world currencies. The EUR/USD quotes updated local highs. Demand for the US currency weakened after the release of weak data on the real estate market, as well as a decrease in the yield of US government bonds. The IMF statements put additional pressure. The regulator said that the US dollar was overvalued by 6-12%, based on short-term economic indicators. At the moment, the EUR/USD quotes are consolidating in the range of 1.12250-1.12450. We recommend opening positions from these marks.

The news feed on 2019.07.18:

The number of initial jobless claims in the US at 15:30 (GMT+3:00);

Philadelphia Fed Manufacturing Index at 15:30 (GMT+3:00).

Indicators do not send accurate signals: the price has fixed between 50 MA and 100 MA.

The MACD histogram is in the positive zone and above the signal line, which gives a strong signal to buy EUR/USD.

Stochastic Oscillator is located near the overbought zone, the %K line has crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.12250, 1.12000, 1.11500

Resistance levels: 1.12450, 1.12750, 1.12850

If the price fixes below 1.12250, the EUR/USD currency pair is expected to decline. The movement is tending to 1.12000-1.11800.

An alternative could be a further recovery of the EUR/USD quotes to 1.12700-1.12850.

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.24075

Open: 1.24313

% chg. over the last day: +0.20

Day’s range: 1.24243 – 1.24478

52 wk range: 1.2397 – 1.3385

The GBP/USD currency pair has begun to recover after a prolonged fall. The trading instrument has updated local extremes. This movement was largely caused by technical factors. At the moment, the GBP/USD quotes are testing a local resistance of 1.24500. The mark of 1.24200 is already a “mirror” support. The pound has the potential for further correction. We recommend keeping track of current information on Brexit. Positions must be opened from key levels.

At 11:30 (GMT+3:00), the UK retail sales statistics for June will be published.

Indicators do not send accurate signals: the price has fixed between 50 MA and 100 MA.

The MACD histogram has started to rise, which signals a further correction of the GBP/USD quotes.

Stochastic Oscillator is located near the overbought zone, the %K line has crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.24200, 1.23850

Resistance levels: 1.24500, 1.24800, 1.25100

If the price fixes above the local resistance of 1.24500, a further correction of the GBP/USD quotes is expected. The movement is tending to the round level of 1.25000.

An alternative would be reduction of the GBP/USD currency pair to 1.24000-1.23800.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.30830

Open: 1.30520

% chg. over the last day: -0.25

Day’s range: 1.30421 – 1.30556

52 wk range: 1.2727 – 1.3664

During the last trading sessions, the USD/CAD currency pair is quite active. At the same time, a unidirectional trend is not observed. At the moment, the loonie is consolidating. Investors expect additional drivers. Local levels of support and resistance are: 1.30350 and 1.30600, respectively. The trading instrument is tending to recover. We recommend paying attention to the dynamics of oil prices. Positions must be opened from key levels.

Today, the news feed on the Canadian economy is calm.

Indicators do not give accurate signals: the price has crossed 50 MA and 100 MA.

The MACD histogram is in the negative zone, but above the signal line, which gives a weak signal to sell USD/CAD.

Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which indicates the bullish sentiment.

Trading recommendations

Support levels: 1.30350, 1.30200, 1.30000

Resistance levels: 1.30600, 1.30750, 1.30900

If the price consolidates above 1.30600, a correction in the USD/CAD currency pair is expected. The movement is tending to 1.30800-1.31000.

An alternative could be a fall of the USD/CAD quotes to 1.30200-1.30000.

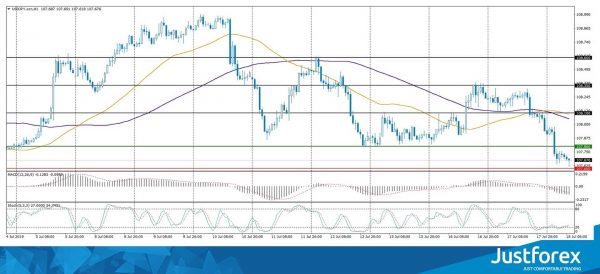

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 108.226

Open: 107.942

% chg. over the last day: -0.28

Day’s range: 107.618 – 107.980

52 wk range: 104.97 – 114.56

On the USD/JPY currency pair the bearish sentiment is prevailing. During yesterday’s and today’s trading sessions, the drop in quotes has exceeded 50 points. The trading instrument has updated key lows. A negative dynamics of the yield of US government bonds puts additional pressure on the “greenback”. The demand for “safe” assets is still high due to the uncertainty in trade relations between the United States and China, as well as the situation around Brexit. At the moment, the USD/JPY quotes are consolidating in the range of 107.600-107.800. The trading instrument is tending to further decline. Positions must be opened from key levels.

In the Asian trading session, ambiguous data on the trade balance of Japan was published.

The price has fixed below 50 MA and 100 MA, which indicates the power of the sellers.

The MACD histogram is located in the negative zone and below the signal line, which gives a strong signal to sell USD/JPY.

Stochastic Oscillator is in the neutral zone, the %K line has crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 107.600, 107.300, 107.000

Resistance levels: 107.800, 108.100, 108.350

If the price fixes below 107.600, a further fall in the USD/JPY quotes is expected. The movement is tending to 107.300-107.000.

An alternative could be the growth of the USD/JPY currency pair to 108.000-108.200.